Business, 21.11.2019 00:31 dacanul100

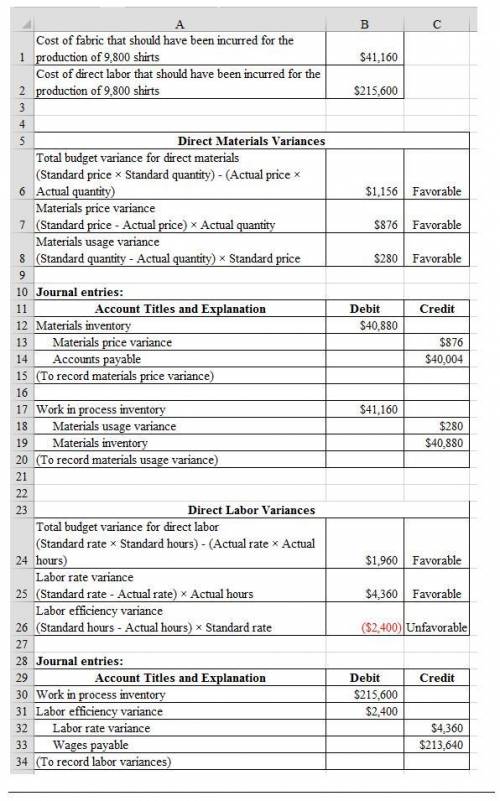

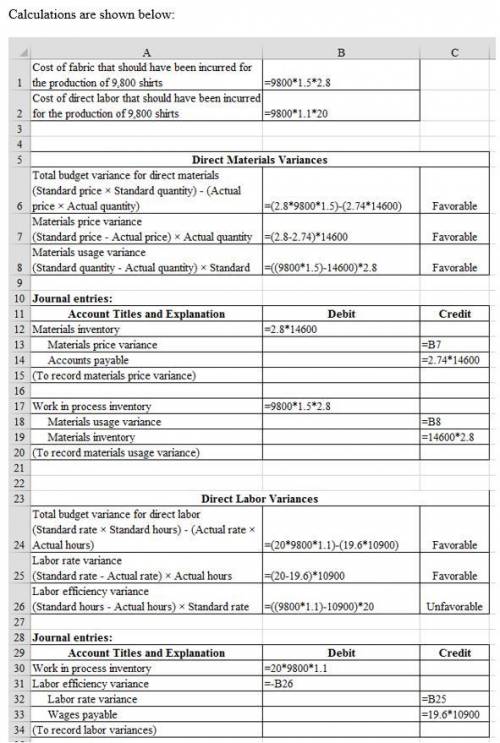

Haversham corporation produces dress shirts. the company uses a standard costing system and has set the followin standards for direct materials and direct labor (for one shirt): fabric ( 1.5 yds. at $2.80) = $4.20 direct labor (1.1 hr. at $20) = 22.00 total prime cost = $26.20 during the year, haversham produced 9,800 shirts. the actual fabric purchased was 14,600 yards at $2.74 per yard. there wer no beginnin or ending inventories of fabric. actual direct labor was 10,900 hours at $19.60 per hour. a. compute the costs of fabric and direct labor that should have been incurred for the production of 9,800 shirts b. compute the total budget variances for direct materials and direct labor. c. break down the total budget variance for direct materials into a price variance and usage variance. prepare the journal entries asscoiated with these variances. d. break down the total budget variance for direct labor into a rate variance and an efficiency variance. prepare the journal entries associated with these variances.

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 22:20, abdulalghazouli

Amachine purchased three years ago for $720,000 has a current book value using straight-line depreciation of $400,000: its operating expenses are $60,000 per year. a replacement machine would cost $480,000, have a useful life of nine years, and would require $26,000 per year in operating expenses. it has an expected salvage value of $130,000 after nine years. the current disposal value of the old machine is $170,000: if it is kept 9 more years, its residual value would be $20,000. calculate the total costs in keeping the old machine and purchase a new machine. should the old machine be replaced?

Answers: 2

Business, 22.06.2019 05:30, tommyaberman

Sally is buying a home and the closing date is set for april 20th. the annual property taxes are $1,234.00 and have not been paid yet. using actual days, how much will the buyer be credited and the seller be debited

Answers: 2

Business, 22.06.2019 20:40, mom1645

Which of the following is true concerning the 5/5 lapse rule? a) the 5/5 lapse rule deems that a taxable gift has been made where a power to withdraw in excess of $5,000 or five percent of the trust assets is lapsed by the powerholder. b) the 5/5 lapse rule only comes into play with a single beneficiary trust. c) amounts that lapse under the 5/5 lapse rule qualify for the annual exclusion. d) gifts over the 5/5 lapse rule do not have to be disclosed on a gift tax return.

Answers: 1

Business, 22.06.2019 22:40, jonlandis6

The year is 2278, and the starship enterprise is running low on dilithium crystals, which are used to regulate the matter-antimatter reactions that propel the ship across the universe. without the crystals, space-time travel is not possible. if there is only one known source of dilithium crystals, the necessary conditions for a monopoly are met. part 2 (1 point)see hint if the crystals are government owned or government regulated, and the government wants to create the greatest welfare for society, then it should set the price choose one or more: a. so only the rich can afford space-time travel. b. at the profit-maximizing price. c. at the efficient price. d. using the marginal-cost pricing rule. e. so everyone can afford space-time travel. f. at the monopoly price.

Answers: 1

You know the right answer?

Haversham corporation produces dress shirts. the company uses a standard costing system and has set...

Questions in other subjects:

Mathematics, 30.05.2020 21:02

Mathematics, 30.05.2020 21:02

Mathematics, 30.05.2020 21:02

Mathematics, 30.05.2020 21:02

Mathematics, 30.05.2020 21:02