Business, 21.11.2019 00:31 martinezzz2294

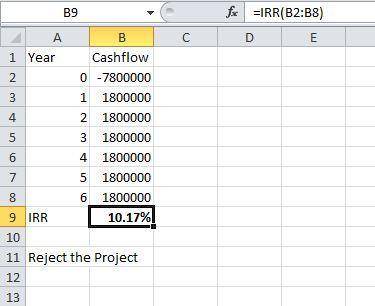

Hathaway, inc., a resort management company, is refurbishing one of its hotels at a cost of $7.8 million. management expects that this will lead to additional cash flows of $1.8 million for the next six years. what is the irr of this project? if the appropriate cost of capital is 12 percent, should hathaway go ahead with this project?

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 23:30, Sebs1

Afreelance​ singer-songwriter is planning the restoration of a recently purchased civil​ war-era farmhouse. while he professes an enjoyment​ of, and talent in the construction​ trades, the theory of comparative advantage implies that a. the value of what he imports​ (in this​ case, professional contractor​ services) must equal the value of what he exports​ (songs). b. he should concentrate on the restoration work since his​ out-of-pocket costs will be much lower than if he hires professionals. c. ​self-sufficiency is​ advantageous, hence he should split his time between music and construction. d. the income lost while away from music will likely exceed the savings realized by doing the work​ himself, thus, he should hire professionals to do the restoration work. e. he ought to do as much of the work himself as possible since imports​ (in this​ case, professional contractor​ services) should always be restricted to those things that cannot be done internall

Answers: 2

Business, 22.06.2019 22:40, tonypewitt

Johnson company uses the allowance method to account for uncollectible accounts receivable. bad debt expense is established as a percentage of credit sales. for 2018, net credit sales totaled $6,400,000, and the estimated bad debt percentage is 1.40%. the allowance for uncollectible accounts had a credit balance of $61,000 at the beginning of 2018 and $49,500, after adjusting entries, at the end of 2018.required: 1. what is bad debt expense for 2018 as a percent of net credit sales? 2. assume johnson makes no other adjustment of bad debt expense during 2018. determine the amount of accounts receivable written off during 2018.3. if the company uses the direct write-off method, what would bad debt expense be for 2018?

Answers: 1

Business, 23.06.2019 07:00, Shamplo8817

Select all of the tools you could use to track your expenses. -budget software -spreadsheet -mint© -automatic bill payment -mvelopes®

Answers: 2

Business, 23.06.2019 15:30, muravyevaarina

Describe at least one way in which a line of credit is different from a loan.

Answers: 1

You know the right answer?

Hathaway, inc., a resort management company, is refurbishing one of its hotels at a cost of $7.8 mil...

Questions in other subjects:

Mathematics, 11.06.2021 21:50

Spanish, 11.06.2021 21:50

Mathematics, 11.06.2021 21:50

Mathematics, 11.06.2021 21:50

Mathematics, 11.06.2021 21:50

History, 11.06.2021 21:50