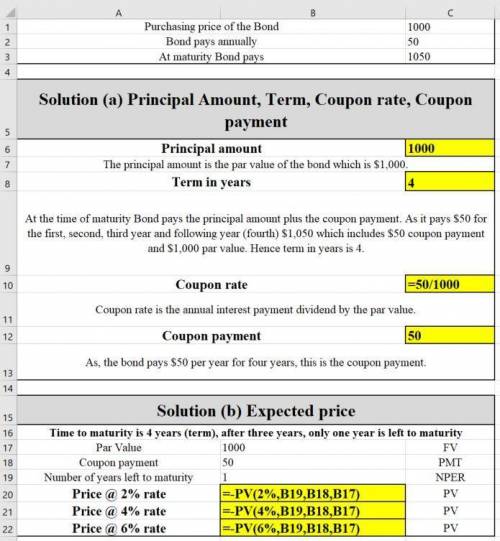

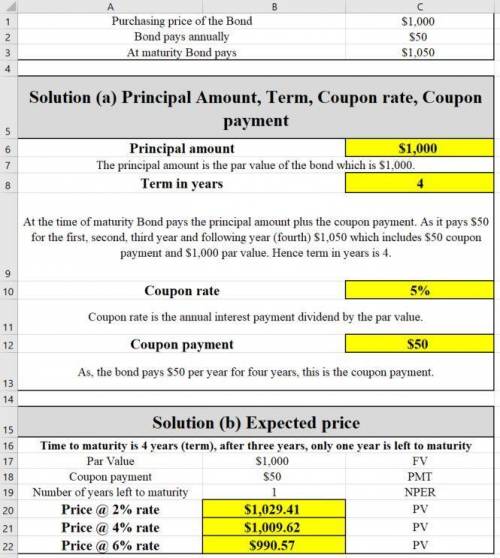

You have just purchased a newly issued municipal bond for $1,000. the bond pays $50 to its holder at the end of the the first, second, and third years and pays $1,050 upon its maturity at the end of the following year. a. what are the principal amount, the term, the coupon rate, and the coupon payment for your bond? instructions: enter your responses as whole numbers. principal amount: $ term: years coupon rate: % coupon payment: $ b. if you decide to sell your bond at the end of 3 years (after receiving the third $50 payment), what price can you expect for your bond if the one-year interest rate at that time is 2 percent? 4 percent? 6 percent? instructions: enter your responses as whole numbers. expected price for the bond at: 2 percent: $ 4 percent: $ 6 percent: $

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 20:30, saltyclamp

Max fischer is a beekeeper. his annual group insurance costs 11,700. his employer pays 60% of the cost. how much does max pay semimonthly for it?

Answers: 1

Business, 22.06.2019 03:10, samantha636

On the first day of the fiscal year, a company issues an $7,500,000, 8%, five-year bond that pays semiannual interest of $300,000 ($7,500,000 × 8% × ½), receiving cash of $7,740,000. journalize the first interest payment and the amortization of the related bond premium. round to the nearest dollar. if an amount box does not require an entry, leave it blank.

Answers: 3

Business, 22.06.2019 06:00, olivernolasco23

Josie just bought her first fish tank a 36 -gallon glass aquarium, which she’s been saving up for almost a year to buy. for josie, the fish tank is most likely what type of purchase

Answers: 1

Business, 22.06.2019 07:00, ladybugys

Pennewell publishing inc. (pp) is a zero growth company. it currently has zero debt and its earnings before interest and taxes (ebit) are $80,000. pp's current cost of equity is 10%, and its tax rate is 40%. the firm has 10,000 shares of common stock outstanding selling at a price per share of $48.00. refer to the data for pennewell publishing inc. (pp). pp is considering changing its capital structure to one with 30% debt and 70% equity, based on market values. the debt would have an interest rate of 8%. the new funds would be used to repurchase stock. it is estimated that the increase in risk resulting from the added leverage would cause the required rate of return on equity to rise to 12%. if this plan were carried out, what would be pp's new value of operations? a. $484,359 b. $521,173 c. $584,653 d. $560,748 e. $487,805

Answers: 1

You know the right answer?

You have just purchased a newly issued municipal bond for $1,000. the bond pays $50 to its holder at...

Questions in other subjects:

Arts, 27.07.2019 10:20

Computers and Technology, 27.07.2019 10:20

Geography, 27.07.2019 10:20

English, 27.07.2019 10:20

Biology, 27.07.2019 10:20