Business, 19.11.2019 23:31 juansantos7b

Tim, a single taxpayer, operates a business as a single-member llc. in 2018, his llc reports business income of $394,000 and business deductions of $689,500, resulting in a loss of $295,500. what are the implications of this business loss?

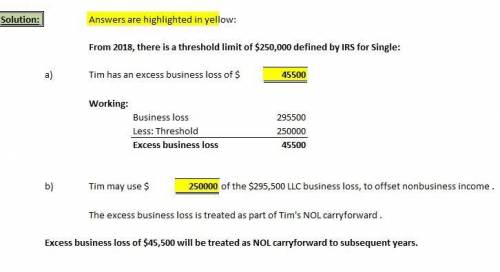

tim has an excess business loss of $

can this business loss be used to offset other income that tim reports? if so, how much? if not, what happens to the loss?

tim may use $ of the $295,500 llc business loss, to offset nonbusiness income . the excess business loss is treated as part of tim's nol carryforward .

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 20:20, smelcher3900

Molander corporation is a distributor of a sun umbrella used at resort hotels. data concerning the next month’s budget appear below: selling price per unit $ 29 variable expense per unit $ 14 fixed expense per month $ 12,450 unit sales per month 980 required: 1. what is the company’s margin of safety? (do not round intermediate calculations.) 2. what is the company’s margin of safety as a percentage of its sales? (round your percentage answer to 2 decimal places (i. e. 0.1234 should be entered as 12.

Answers: 3

Business, 22.06.2019 16:30, AriaMartinez

Corrective action must be taken for a project when (a) actual progress to the planned progress shows the progress is ahead of schedule. (b) the technical specifications have been met. (c) the actual cost of the activities is less than the funds received for the work completed. (d) the actual progress is less than the planned progress.

Answers: 2

Business, 22.06.2019 17:40, payloo

To appeal to a new target market, the maker of hill's coffee has changed the product's package design, reformulated the coffee, begun advertising price discounts in women's magazines, and started distributing the product through gourmet coffee shops. what has been changed? a. the product's perceptual value. b. the product's 4ps. c. the method used in its target marketing. d. the ownership of the product line. e. the product's utility.

Answers: 3

You know the right answer?

Tim, a single taxpayer, operates a business as a single-member llc. in 2018, his llc reports busines...

Questions in other subjects:

Mathematics, 11.03.2021 17:50

Health, 11.03.2021 17:50

English, 11.03.2021 17:50

Mathematics, 11.03.2021 17:50