Acompany is considering buying a new piece of machinery. a 10% interest rate will be used in the computations. two models of the machine are available.

machine i

initial cost: $80,000

end -of -useful –life salvage value, s: 20,000

annual operating cost 18,000

useful life, in years 20

machine ii

initial cost: $100,000

end -of -useful –life salvage value, s: 25,000

annual operating cost: 15,000 first 10 years, 20,000 thereafter

useful life, in years: 25

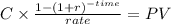

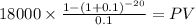

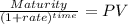

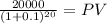

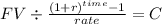

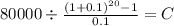

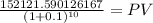

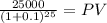

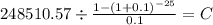

(a) determine which machine should be purchased, based on equivalent uniform annual cost.

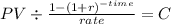

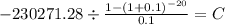

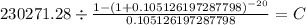

(b) what is the capitalized cost of machine i?

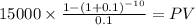

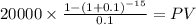

(c) machine i is purchased and a fund is set up to replace machine i at the end of 20 years. compute the required uniform annual deposit.

(d) machine i will produce an annual saving of material of $28,000. what is the rate of return if machine i is installed?

(e) what will be the book value of machine i after 2 years, based on sum -of -years' -digits depreciation?

(f) what will be the book value of machine ii after 3 years, based on double declining balance depreciation?

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 03:30, 3steves

Diversified semiconductors sells perishable electronic components. some must be shipped and stored in reusable protective containers. customers pay a deposit for each container received. the deposit is equal to the container’s cost. they receive a refund when the container is returned. during 2018, deposits collected on containers shipped were $856,000. deposits are forfeited if containers are not returned within 18 months. containers held by customers at january 1, 2018, represented deposits of $587,000. in 2018, $811,000 was refunded and deposits forfeited were $41,000. required: 1. prepare the appropriate journal entries for the deposits received and returned during 2018. 2. determine the liability for refundable deposits to be reported on the december 31, 2018, balance sheet.

Answers: 1

Business, 22.06.2019 13:40, vanessam16

Salge inc. bases its manufacturing overhead budget on budgeted direct labor-hours. the variable overhead rate is $8.10 per direct labor-hour. the company's budgeted fixed manufacturing overhead is $74,730 per month, which includes depreciation of $20,670. all other fixed manufacturing overhead costs represent current cash flows. the direct labor budget indicates that 5,300 direct labor-hours will be required in september. the company recomputes its predetermined overhead rate every month. the predetermined overhead rate for september should be:

Answers: 3

Business, 22.06.2019 21:30, mydoggy152

Which of the following best explains the purpose of protectionist trade policies such as tariffs and subsidies? a. they make sure that governments have enough money to pay for fiscal policies. b. they give foreign competitors access to new markets around the world. c. they allow producers to sell their products more cheaply than foreign competitors. d. they enable producers to purchase productive resources from everywhere in the world.

Answers: 1

Business, 22.06.2019 23:50, Izzyfizzy

Cash flows during the first year of operations for the harman-kardon consulting company were as follows: cash collected from customers, $360,000; cash paid for rent, $44,000; cash paid to employees for services rendered during the year, $124,000; cash paid for utilities, $54,000.in addition, you determine that customers owed the company $64,000 at the end of the year and no bad debts were anticipated. also, the company owed the gas and electric company $2,400 at year-end, and the rent payment was for a two-year period. calculate accrual net income for the year.

Answers: 2

You know the right answer?

Acompany is considering buying a new piece of machinery. a 10% interest rate will be used in the com...

Questions in other subjects:

World Languages, 27.06.2019 00:00

English, 27.06.2019 00:00