Business, 14.11.2019 04:31 hhhhhh8897

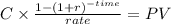

The oviedo company is considering the purchase of a new machine to replace an obsolete one. the machine being used for the operation has a book value and a market value of zero. however, the machine is in good working order and will last at least another 10 years. the proposed replacement machine will perform the operation so much more efficiently that oviedo’s engineers estimate that it will produce after-tax cash flows (labor savings) of $8,000 per year. the after-tax cost of the new machine is $45,000, and its economic life is estimated to be 10 years. it has zero salvage value. the firm’s wacc is 10%, and its marginal tax rate is 25%. should oviedo buy the new machine?

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 08:40, jasonr182017

During january 2018, the following transactions occur: january 1 purchase equipment for $20,600. the company estimates a residual value of $2,600 and a five-year service life. january 4 pay cash on accounts payable, $10,600. january 8 purchase additional inventory on account, $93,900. january 15 receive cash on accounts receivable, $23,100 january 19 pay cash for salaries, $30,900. january 28 pay cash for january utilities, $17,600. january 30 firework sales for january total $231,000. all of these sales are on account. the cost of the units sold is $120,500. the following information is available on january 31, 2018. depreciation on the equipment for the month of january is calculated using the straight-line method. the company estimates future uncollectible accounts. at the end of january, considering the total ending balance of the accounts receivable account as shown on the general ledger tab, $4,100 is now past due (older than 90 days), while the remainder of the balance is current (less than 90 days old). the company estimates that 50% of the past due balance will be uncollectible and only 3% of the current balance will become uncollectible. record the estimated bad debt expense. accrued interest revenue on notes receivable for january. unpaid salaries at the end of january are $33,700. accrued income taxes at the end of january are $10,100

Answers: 2

Business, 22.06.2019 11:30, deedivinya

What would you do as ceo to support the goals of japan airlines during the challenging economics that airlines face?

Answers: 1

You know the right answer?

The oviedo company is considering the purchase of a new machine to replace an obsolete one. the mach...

Questions in other subjects:

Geography, 13.07.2019 04:00

English, 13.07.2019 04:00

English, 13.07.2019 04:00