Business, 13.11.2019 06:31 pgfrkypory2107

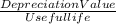

Shahia company bought a building for $88,000 cash and the land on which it was located for $117,000 cash. the company paid transfer costs of $16,000 ($4,000 for the building and $12,000 for the land). renovation costs on the building before it could be used were $25,000. 2. compute straight-line depreciation at the end of one year, assuming an estimated 10-year useful life and a $8,000 estimated residual value.

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 00:30, kierafisher05

You wants to open a saving account. which account will grow his money the most

Answers: 1

Business, 22.06.2019 10:00, caz27

Your uncle is considering investing in a new company that will produce high quality stereo speakers. the sales price would be set at 1.5 times the variable cost per unit; the variable cost per unit is estimated to be $75.00; and fixed costs are estimated at $1,200,000. what sales volume would be required to break even, i. e., to have ebit = zero?

Answers: 1

Business, 22.06.2019 11:40, thedarcieisabelleand

Select the correct answer. which is a benefit of planning for your future career? a. being less prepared after high school. b. having higher tuition in college. c. earning college credits in high school. d. ruining your chances of having a successful career.

Answers: 2

Business, 22.06.2019 19:50, joel4676

The new york company produces high quality chairs. variable manufacturing overhead is applied at a standard rate of $12 per machine hour. each chair requires a standard quantity of six machine hours. production for the month totaled 4,000 units. calculate: the standard cost per unit for variable overhead. select one: a. $130,000 b. $192,000 c. $90,000 d. $100,000

Answers: 2

You know the right answer?

Shahia company bought a building for $88,000 cash and the land on which it was located for $117,000...

Questions in other subjects:

Mathematics, 13.10.2020 15:01

Mathematics, 13.10.2020 15:01

Biology, 13.10.2020 15:01

Mathematics, 13.10.2020 15:01

Spanish, 13.10.2020 15:01

Mathematics, 13.10.2020 15:01