Business, 12.11.2019 00:31 tajanaewilliams77

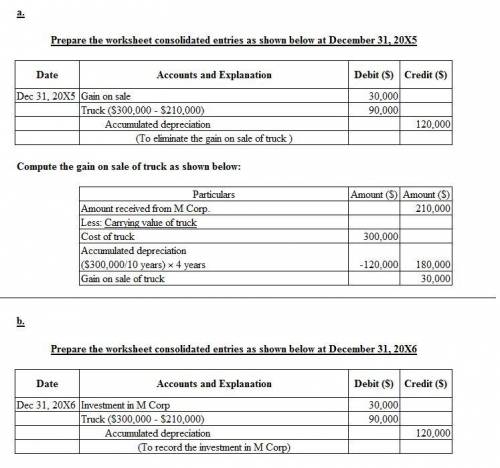

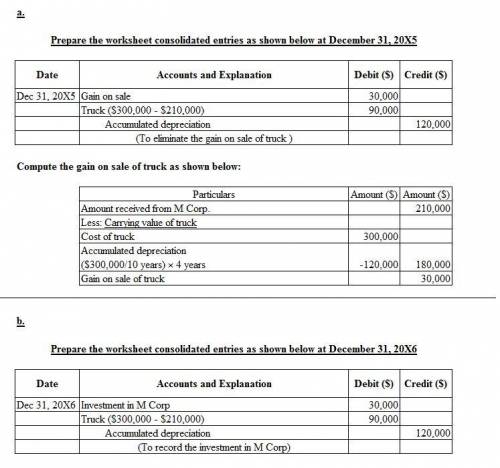

Frazer corporation purchased 60 percent of minnow corporation's voting common stock on january 1, 20x1, at underlying book value. on january 1, 20x5, frazer received $210,000 from minnow for a truck frazer had purchased on january 1, 20x2, for $300,000. the truck is expected to have a 10-year useful life and no salvage value. both companies depreciate trucks on a straight-line basis.

required

a. give the workpaper eliminating entry or entries needed at december 31, 20x5, to remove the effects of the intercompany sale.

b. give the workpaper eliminating entry or entries needed at december 31, 20x6, to remove the effects of the intercompany sale.

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 21:00, FombafTejanjr3923

The plastic flowerpots company has two manufacturing departments, molding and packaging. at the beginning of the month, the molding department has 2,100 units in inventory, 70% complete as to materials. during the month, the molding department started 18,500 units. at the end of the month, the molding department had 3,150 units in ending inventory, 80% complete as to materials. units completed in the molding department are transferred into the packaging department. cost information for the molding department for the month follows: beginning work in process inventory (direct materials) $ 1,300 direct materials added during the month 28,900 using the weighted-average method, compute the molding department's (a) equivalent units of production for materials and (b) cost per equivalent unit of production for materials for the month. (round "cost per equivalent unit of production" to 2 decimal places.)

Answers: 1

Business, 22.06.2019 12:20, Tierriny576

If jobs have been undercosted due to underallocation of manufacturing overhead, then cost of goods sold (cogs) is too low and which of the following corrections must be made? a. decrease cogs for double the amount of the underallocation b. increase cogs for double the amount of the underallocation c. decrease cogs for the amount of the underallocation d. increase cogs for the amount of the underallocation

Answers: 3

Business, 22.06.2019 14:30, 20guadalupee73248

The face of a company is often that of the lowest paid employees who meet the customers. select one: true false

Answers: 1

You know the right answer?

Frazer corporation purchased 60 percent of minnow corporation's voting common stock on january 1, 20...

Questions in other subjects:

Social Studies, 07.01.2020 00:31

Mathematics, 07.01.2020 00:31

Social Studies, 07.01.2020 00:31

Social Studies, 07.01.2020 00:31