Reba dixon is a fifth-grade school teacher who earned a salary of $38,000 in 2019. she is 45 years old and has been divorced for four years. she receives $1,200 of alimony payments each month from her former husband (divorced in 2016). reba also rents out a small apartment building. this year reba received $50,000 of rental payments from tenants and she incurred $19,500 of expenses associated with the rental.

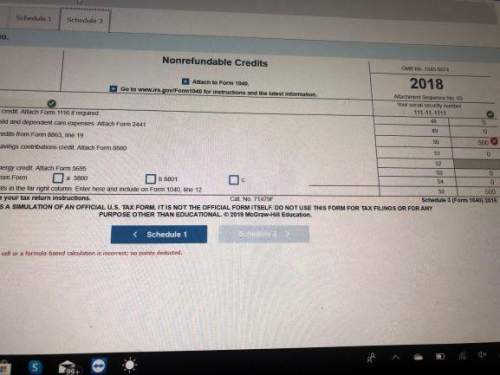

reba and her daughter heather (20 years old at the end of the year) moved to georgia in january of this year. reba provides more than one-half of heather's support. they had been living in colorado for the past 15 years, but ever since her divorce, reba has been wanting to move back to georgia to be closer to her family. luckily, last december, a teaching position opened up and reba and heather decided to make the move. reba paid a moving company $2,010 to move their personal belongings, and she and heather spent two days driving the 1,426 miles to georgia. reba rented a home in georgia. heather decided to continue living at home with her mom, but she started attending school full-time in january and throughout the rest of the year at a nearby university. she was awarded a $3,000 partial tuition scholarship this year, and reba out by paying the remaining $500 tuition cost. if possible, reba thought it would be best to claim the education credit for these expenses. reba wasn't sure if she would have enough items to her benefit from itemizing on her tax return. however, she kept track of several expenses this year that she thought might qualify if she was able to itemize. reba paid $5,800 in state income taxes and $12,500 in charitable contributions during the year. she also paid the following medical-related expenses for herself and heather:

insurance premiums : $ 7,952

medical care expenses: $ 1,100

prescription medicine: $ 350

nonprescription medicine : $ 100

new contact lenses for heather: $ 200

shortly after the move, reba got distracted while driving and she ran into a street sign. the accident caused $900 in damage to the car and gave her whiplash. because the repairs were less than her insurance deductible, she paid the entire cost of the repairs. reba wasn't able to work for two months after the accident. fortunately, she received $2,000 from her disability insurance. her employer, the central georgia school district, paid 60 percent of the premiums on the policy as a nontaxable fringe benefit and reba paid the remaining 40 percent portion.

a few years ago, reba acquired several investments with her portion of the divorce settlement. this year she reported the following income from her investments: $2,200 of interest income from corporate bonds and $1,500 interest income from city of denver municipal bonds. overall, reba's stock portfolio appreciated by $12,000 but she did not sell any of her stocks. heather reported $6,200 of interest income from corporate bonds she received as gifts from her father over the last several years. this was heather's only source of income for the year.

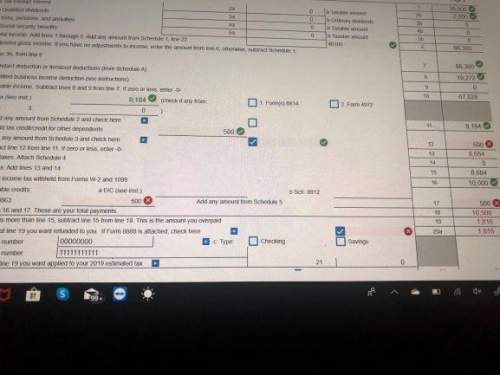

reba had $10,000 of federal income taxes withheld by her employer. heather made $1,000 of estimated tax payments during the year. reba did not make any estimated payments. reba had qualifying insurance for purposes of the affordable care act (aca).

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 19:50, Pookaapoo8832

Which of the following best describes the economic effect that results when the government increases interest rates and restricts the lending of money? a. borrowing money becomes more expensive and there is less investment in production. b. the economy grows as investments result in larger profits. c. government spending drives up prices because of greater competition for goods and services. d. consumers save more money and spend less buying goods and services.

Answers: 2

Business, 22.06.2019 04:30, awdadaddda

Galwaysc electronics makes two products. model a requires component a and component c. model b requires component b and component c. new versions of both models are released each year with updated versions of all components. all components are sourced overseas, and abc contracts annually for a quantity of each component before seeing that year’s demand. components are only assembled into finished products once demand for each model is known. for the coming year, alwaysc’s purchasing manner has proposed ordering 500,000 units of component a, 630,000 of component b, and 1,000,000 units of component c. her boss has asked why she has recommended purchasing so much of components a and b when alwaysc will not have enough of component c to fully use all of the inventory of a and b. what factors might the purchasing manager cite to explain her recommended order? explain your reasoning.

Answers: 3

Business, 22.06.2019 17:00, ruchierosanp1n3qw

You hold a diversified $100,000 portfolio consisting of 20 stocks with $5,000 invested in each. the portfolio's beta is 1.12. you plan to sell a stock with b = 0.90 and use the proceeds to buy a new stock with b = 1.50. what will the portfolio's new beta be? do not round your intermediate calculations.

Answers: 2

Business, 22.06.2019 18:00, judali

David paid $975,000 for two beachfront lots in coastal south carolina, with the intention of building residential homes on each. two years later, the south carolina legislature passed the beachfront management act, barring any further development of the coast, including david's lots. when david files a complaint to seek compensation for his property, south carolina refuses, pointing to a passage in david's own complaint that states "the beachfront management act [was] properly and validly designed to south carolina's " is south carolina required to compensate david under the takings clause?

Answers: 1

You know the right answer?

Reba dixon is a fifth-grade school teacher who earned a salary of $38,000 in 2019. she is 45 years o...

Questions in other subjects:

Chemistry, 25.01.2020 08:31

Mathematics, 25.01.2020 08:31

Social Studies, 25.01.2020 08:31

Physics, 25.01.2020 08:31

Computers and Technology, 25.01.2020 08:31

Mathematics, 25.01.2020 08:31