Business, 08.11.2019 07:31 Sfowler5129

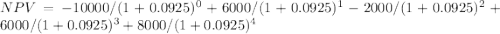

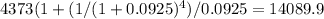

Atlas corp. is considering two mutually exclusive projects. both require an initial investment of $10,000 at t = 0. project s has an expected life of 2 years with after-tax cash inflows of $6,000 and $8,000 at the end of years 1 and 2, respectively. project l has an expected life of 4 years with after-tax cash inflows of $4,373 at the end of each of the next 4 years. each project has a wacc of 9.25%, and project s can be repeated with no changes in its cash flows. the controller prefers project s, but the cfo prefers project l. how much value will the firm gain or lose if project l is selected over project s, i. e., what is the value of npvl - npvs? a. $56.50b. $62.15c. $68.37d. $75.21e. $82.73

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 21:20, khalilh1206

Vital industries manufactured 2 comma 200 units of its product huge in the month of april. it incurred a total cost of $ 121 comma 000 during the month. out of this $ 121 comma 000, $ 46 comma 000 comprised of direct materials used in the product and the rest was incurred because of the conversion cost involved in the process. ryan had no opening or closing inventory. what will be the total cost per unit of the product, assuming conversion costs contained $ 10 comma 900 of indirect labor?

Answers: 1

Business, 22.06.2019 16:50, babydolltia28

The cost of labor is significantly lower in many countries than in the united states. if you move manufacturing to a facility to a country labeled as part of the axis of evil and a threat to world peace you will increase the net income of your client by $10 million per the facility is located in a country which limits personal freedom and engages in state sponsored terrorism. imagine you are a marketing consultant. (a) what would you tell the executives to do? (b) what are the alternatives? what are your recommendations? why do you recommend this course of action?

Answers: 1

Business, 22.06.2019 21:00, thicklooney

You are given the following information about aggregate demand at the existing price level for an economy: (1) consumption = $400 billion, (2) investment = $40 billion, (3) government purchases = $90 billion, and (4) net export = $25 billion. if the full-employment level of gdp for this economy is $600 billion, then what combination of actions would be most consistent with closing the gdp gap here?

Answers: 3

Business, 23.06.2019 06:10, lilymoniquesalaiz

Which of the following functions finds the highest value of selected inputs? a. high b. hvalue c. max

Answers: 3

You know the right answer?

Atlas corp. is considering two mutually exclusive projects. both require an initial investment of $1...

Questions in other subjects:

Mathematics, 22.08.2019 15:10

Spanish, 22.08.2019 15:10

Mathematics, 22.08.2019 15:10

English, 22.08.2019 15:10

Physics, 22.08.2019 15:10

English, 22.08.2019 15:10