Aland surveyor just starting in private practice needs a van to carry crew and

equipment. he c...

Business, 08.11.2019 03:31 angelapegues20097

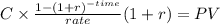

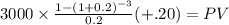

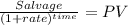

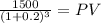

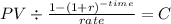

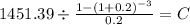

Aland surveyor just starting in private practice needs a van to carry crew and

equipment. he can lease a used van for $3,000 per year, paid at the

beginning of each year, in which case maintenance is provided. alternatively,

he can buy a used van for $7,000 and pay for maintenance himself. he

expects to keep the van three years at which time he could sell it for $1,500.

what is the most he should pay for uniform annual maintenance to make it

worthwhile buying the van instead of leasing it, if his pre-tax marr is 20%?

4

answer in dollars, without dollar sign or other symbols

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 17:30, adenn3693

You want to paint your room yellow, so you get some samples at the paint store. when you hold the sample against your white wall, it looks different from the way it looks against the green curtain. a psychologist would attribute this to perceptual constancy. visual paradoxes. contrast effects. threshold differences.

Answers: 3

Business, 22.06.2019 17:40, rave35

Croy inc. has the following projected sales for the next five months: month sales in units april 3,850 may 3,875 june 4,260 july 4,135 august 3,590 croy’s finished goods inventory policy is to have 60 percent of the next month’s sales on hand at the end of each month. direct material costs $2.50 per pound, and each unit requires 2 pounds. raw materials inventory policy is to have 50 percent of the next month’s production needs on hand at the end of each month. raw materials on hand at march 31 totaled 3,741 pounds. 1. determine budgeted production for april, may, and june. 2. determine the budgeted cost of materials purchased for april, may, and june. (round your answers to 2 decimal places.)

Answers: 3

Business, 22.06.2019 19:10, jonmorton159

The stock of grommet corporation, a u. s. company, is publicly traded, with no single shareholder owning more than 5 percent of its outstanding stock. grommet owns 95 percent of the outstanding stock of staple inc., also a u. s. company. staple owns 100 percent of the outstanding stock of clip corporation, a canadian company. grommet and clip each own 50 percent of the outstanding stock of fastener inc., a u. s. company. grommet and staple each own 50 percent of the outstanding stock of binder corporation, a u. s. company. which of these corporations form an affiliated group eligible to file a consolidated tax return?

Answers: 3

You know the right answer?

Questions in other subjects:

Mathematics, 26.02.2021 01:00

Mathematics, 26.02.2021 01:00

Mathematics, 26.02.2021 01:00

Mathematics, 26.02.2021 01:00

Mathematics, 26.02.2021 01:00

Mathematics, 26.02.2021 01:00

Advanced Placement (AP), 26.02.2021 01:00