Business, 07.11.2019 07:31 kell22wolf

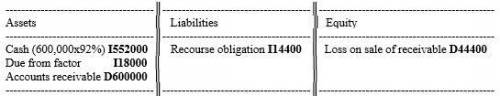

Mini corporation factored, with recourse, $600,000 of accounts receivable with huskie financing. the agreement met all three conditions to be considered an outright sale. huskie advanced 92% of the amount factored and retained the remainder to cover a 3% finance fee (to be remitted at the end of the agreement) and any sales returns/allowances/discounts. the recourse obligation is estimated to be 2.4% of accounts factored. mini estimates the fair value of the final 8% of the receivables factored to be $43,000.

determine the effect of this transaction on mini’s financial position: (use i for increased; d for decreased; or ne for no effect. if there is an effect, state the dollar amount. indicate the letter first, then the number. do not space between the letter and number. do not use commas. for example, if your answer is "decreased by $4,000", enter d4000).

assets

liabilities

equity

blank 1

blank 2

blank 3

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 01:00, jonzyjones3114

Bond x is noncallable and has 20 years to maturity, a 7% annual coupon, and a $1,000 par value. your required return on bond x is 10%; if you buy it, you plan to hold it for 5 years. you (and the market) have expectations that in 5 years, the yield to maturity on a 15-year bond with similar risk will be 9.5%. how much should you be willing to pay for bond x today? (hint: you will need to know how much the bond will be worth at the end of 5 years.) do not round intermediate calculations. round your answer to the nearest cent.

Answers: 3

Business, 22.06.2019 04:00, neariah24

Assume that the following conditions exist: a. all banks are fully loaned up- there are no excess reserves, and desired excess reserves are always zero. b. the money multiplier is 5 . c. the planned investment schedule is such that at a 4 percent rate of interest, investment =$1450 billion. at 5 percent, investment is $1420 billion. d. the investment multiplier is 3 . e.. the initial equilibrium level of real gdp is $12 trillion. f. the equilibrium rate of interest is 4 percent now the fed engages in contractionary monetary policy. it sells $1 billion worth of bonds, which reduces the money supply, which in turn raises the market rate of interest by 1 percentage point. calculate the decrease in money supply after fed's sale of bonds: $nothing billion.

Answers: 2

Business, 22.06.2019 10:20, Sparkledog

Blue spruce corp. has the following transactions during august of the current year. aug. 1 issues shares of common stock to investors in exchange for $10,170. 4 pays insurance in advance for 3 months, $1,720. 16 receives $710 from clients for services rendered. 27 pays the secretary $740 salary. indicate the basic analysis and the debit-credit analysis.

Answers: 1

Business, 22.06.2019 14:30, rakanmadi87

If a product goes up in price, and the demand for it drops, that product's demand is a. elastic b. inelastic c. stable d. fixed select the best answer from the choices provided

Answers: 1

You know the right answer?

Mini corporation factored, with recourse, $600,000 of accounts receivable with huskie financing. the...

Questions in other subjects:

Arts, 22.02.2021 18:20

Chemistry, 22.02.2021 18:20

Business, 22.02.2021 18:20

Chemistry, 22.02.2021 18:20