Business, 06.11.2019 05:31 liloleliahx2

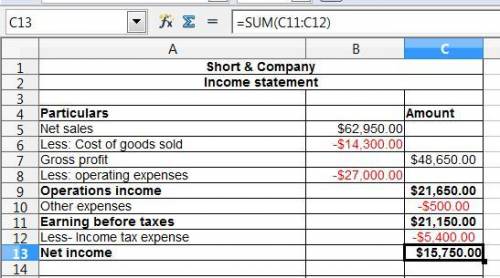

Presented below is income statement data for short & company as of year-end 2019: income tax expense $5,400 cost of goods sold 14,300 other expenses 500 net revenue 62,950 operating expenses 27,000 required prepare a multi-step income statement for 2019. note: do not use negative signs with your answers. short & company income statement 2019 answer answer answer answer gross profit on sales answer answer answer operating income answer answer answer income before income taxes answer answer answer net income answer calculate the company's return on sales ratio. round the return on sales ratio to one decimal place. if short's return on sales was 16 percent in 2018, is the company's profitability improving or declining? return of sales for 2019= answer and thus, the company's profitability is answer

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 20:30, Felici6086

Partnerships are the most common type of business firms in the world. t/f

Answers: 3

Business, 22.06.2019 00:50, emma3216

cranium, inc., purchases term papers from an overseas supplier under a continuous review system. the average demand for a popular mode is 300 units a day with a standard deviation of 30 units a day. it costs $60 to process each order and there is a five−day lead−time. the holding cost for a paper is $0.25 per year and the company policy is to maintain a 98% service level. cranium operates 200 days per year. what is the reorder point r to satisfy a 98% cycleminus−service level? a. greater than 1,700 unitsb. greater than 1,600 units but less than or equal to 1,700 unitsc. greater than 1,500 units but less than or equal to 1,600 unitsd. less than or equal to 1,500 units

Answers: 1

Business, 22.06.2019 05:40, Jenan25

Grant, inc., acquired 30% of south co.’s voting stock for $200,000 on january 2, year 1, and did not elect the fair value option. the price equaled the carrying amount and the fair value of the interest purchased in south’s net assets. grant’s 30% interest in south gave grant the ability to exercise significant influence over south’s operating and financial policies. during year 1, south earned $80,000 and paid dividends of $50,000. south reported earnings of $100,000 for the 6 months ended june 30, year 2, and $200,000 for the year ended december 31, year 2. on july 1, year 2, grant sold half of its stock in south for $150,000 cash. south paid dividends of $60,000 on october 1, year 2. before income taxes, what amount should grant include in its year 1 income statement as a result of the investment?

Answers: 1

Business, 22.06.2019 19:40, raewalker23p4ibhy

Banana computers has decided to procure processing chips required for its laptops from external suppliers instead of manufacturing them in their own facilities. how will this decision affect the firm? a. the firm will be protected against the principal-agent problem. b. the firm's administrative costs will be low because of necessary bureaucracy. c. the firm will have more flexibility in purchasing and comparing prices of goods and services. d. the firm will have high-powered incentives, such as hourly wages and salaries.

Answers: 3

You know the right answer?

Presented below is income statement data for short & company as of year-end 2019: income tax e...

Questions in other subjects:

Mathematics, 17.01.2021 21:30

Mathematics, 17.01.2021 21:30

Mathematics, 17.01.2021 21:30

Mathematics, 17.01.2021 21:30

Engineering, 17.01.2021 21:30

Chemistry, 17.01.2021 21:30

Chemistry, 17.01.2021 21:30