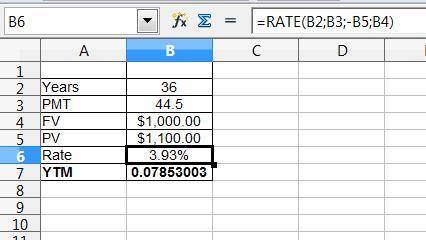

West corp. issued 20-year bonds two years ago at a coupon rate of 8.9 percent. the bonds make semiannual payments. if these bonds currently sell for 110 percent of par value, what is the ytm? (do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e. g., 32.16.)

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 19:50, alexdziob01

Right medical introduced a new implant that carries a five-year warranty against manufacturer’s defects. based on industry experience with similar product introductions, warranty costs are expected to approximate 2% of sales. sales were $8 million and actual warranty expenditures were $42,750 for the first year of selling the product. what amount (if any) should right report as a liability at the end of the year?

Answers: 2

Business, 22.06.2019 22:30, nevejames07

Experts are particularly concerned about four strategic metal resources that are important for the u. s. economy and military strength, and that must be imported. what percentage does the u. s. import? *

Answers: 2

Business, 23.06.2019 01:50, davidb1113

Which term best describes the statement given below? if p = q and q = r, then p = r

Answers: 1

Business, 23.06.2019 05:10, lovelife132015

To use google as main search engine, which internet browser can i use

Answers: 2

You know the right answer?

West corp. issued 20-year bonds two years ago at a coupon rate of 8.9 percent. the bonds make semian...

Questions in other subjects:

Mathematics, 02.12.2020 23:30

Mathematics, 02.12.2020 23:30

Mathematics, 02.12.2020 23:30

Mathematics, 02.12.2020 23:30

Mathematics, 02.12.2020 23:30

Mathematics, 02.12.2020 23:30