Business, 05.11.2019 05:31 Adeenieweenie

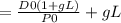

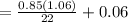

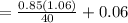

The ceo of harding media inc. as asked you to estimate its cost of common equity. you have obtained the following data: d0 = $0.85; p0 = $22.00; and gl = 6.00% (constant). the ceo thinks, however, that the stock price is temporarily depressed, and that it will soon rise to $40.00. based on the dividend growth model, by how much would the cost of common from reinvested earnings change if the stock price changes as the ceo expects? a. −1.49%b. −1.66%c. −1.84%d. −2.03%e. −2.23%

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 22:30, ringo12384

Quantitative problem: you need $20,000 to purchase a used car. your wealthy uncle is willing to lend you the money as an amortized loan. he would like you to make annual payments for 4 years, with the first payment to be made one year from today. he requires a 8% annual return. what will be your annual loan payments? round your answer to the nearest cent. do not round intermediate calculations. $ how much of your first payment will be applied to interest and to principal repayment? round your answer to the nearest cent. do not round intermediate calculations. interest: $ principal repayment

Answers: 1

Business, 22.06.2019 07:50, sis212

Connors academy reported inventory in the 2017 year-end balance sheet, using the fifo method, as $154,000. in 2018, the company decided to change its inventory method to lifo. if the company had used the lifo method in 2017, the company estimates that ending inventory would have been in the range $130,000-$135,000. what adjustment would connors make for this change in inventory method?

Answers: 1

Business, 22.06.2019 12:50, DesperatforanA

Demand increases by less than supply increases. as a result, (a) equilibrium price will decline and equilibrium quantity will rise. (b) both equilibrium price and quantity will decline. (c) both equilibrium price and quantity will rise

Answers: 3

Business, 22.06.2019 13:30, lorip7799ov3qr0

The purpose of safety stock is to: a. eliminate the possibility of a stockout. b. control the likelihood of a stockout due to variable demand and/or lead time. c. eliminate the likelihood of a stockout due to erroneous inventory tally. d. protect the firm from a sudden decrease in demand. e. replace failed units with good ones.

Answers: 1

You know the right answer?

The ceo of harding media inc. as asked you to estimate its cost of common equity. you have obtained...

Questions in other subjects:

Mathematics, 03.09.2021 05:30

Mathematics, 03.09.2021 05:30

English, 03.09.2021 05:30

Social Studies, 03.09.2021 05:30

English, 03.09.2021 05:30

Chemistry, 03.09.2021 05:30