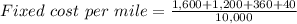

Kristen lu purchased a used automobile for $8,000 at the beginning of last year and incurred the following operating costs: depreciation ($8,000 ÷ 5 years) $1,600 insurance $1,200 garage rent $360 automobile tax and license $40 variable operating cost $0.14 per mile the variable operating cost consists of gasoline, oil, tires, maintenance, and repairs. kristen estimates that, at her current rate of usage, the car will have zero resale value in five years, so the annual straight-line depreciation is $1,600. the car is kept in a garage for a monthly fee. kristen drove the car 10,000 miles last year. compute the average cost per mile of owning and operating the car. (round your answers to 2 decimal places.)

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 17:00, ahatton15

Herman is covered by a cafeteria plan by his employer. his adjusted gross income (agi) is $100,000. he paid unreimbursed medical premiums in the amount of $10,500 and he itemizes deductions. what amount will herman be able to deduct for his medical insurance premium expenses?

Answers: 1

Business, 21.06.2019 21:00, nwatase

Resources and capabilities, such as interpersonal relations among managers and a firm's culture, that may be costly to imitate because they are beyond the ability of firms to systematically manage and influence are referred to asanswers: socially complex. causally ambiguous. path dependent. the result of unique historical conditions.

Answers: 3

Business, 22.06.2019 11:30, khynia11

Given the following information about the closed economy of brittania, what is the level of investment spending and private savings, and what is the budget balance? assume there are no government transfers. gdp=$1180.00 million =$510.00 million =$380.00 million =$280.00 million

Answers: 3

Business, 22.06.2019 13:30, lemmeboiz43

The fiscal 2016 financial statements of nike inc. shows average net operating assets (noa) of $8,450 million, average net nonoperating obligations (nno) of $(4,033) million, average total liabilities of $9,014 million, and average equity of $12,483 million. the company's 2016 financial leverage (flev) is: select one: a. (0.477) b. (0.559 c. (0.323) d. (0.447) e. there is not enough information to determine the ratio.

Answers: 2

You know the right answer?

Kristen lu purchased a used automobile for $8,000 at the beginning of last year and incurred the fol...

Questions in other subjects:

English, 07.10.2020 03:01

History, 07.10.2020 03:01

Social Studies, 07.10.2020 03:01

Mathematics, 07.10.2020 03:01