Business, 24.10.2019 04:30 Woodlandgirl14

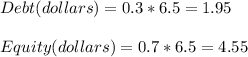

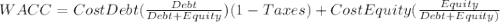

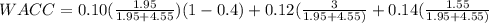

Olsen outfitters inc. believes that its optimal capital structure consists of 70% common equity and 30% debt, and its tax rate is 40%. olsen must raise additional capital to fund its upcoming expansion. the firm will have $3 million of retained earnings with a cost of rs = 12%. new common stock in an amount up to $7 million would have a cost of re = 14%. furthermore, olsen can raise up to $2 million of debt at an interest rate of rd = 10% and an additional $4 million of debt at rd = 11%. the cfo estimates that a proposed expansion would require an investment of $6.5 million. what is the wacc for the last dollar raised to complete the expansion? round your answer to two decimal places.

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 20:30, christinachavez081

The federal act which provided over $7 billion to the epa to protect and promote "green" jobs and a healthier environment is the - national environmental policy act. - resource recovery act.- resource conservation and recovery act.- american recovery and reinvestment act. - clean air act.

Answers: 1

Business, 22.06.2019 13:30, ayoismeisalex

On january 2, well co. purchased 10% of rea, inc.’s outstanding common shares for $400,000, which equaled the carrying amount and the fair value of the interest purchased in rea’s net assets. well did not elect the fair value option. because well is the largest single shareholder in rea, and well’s officers are a majority on rea’s board of directors, well exercises significant influence over rea. rea reported net income of $500,000 for the year and paid dividends of $150,000. in its december 31 balance sheet, what amount should well report as investment in rea?

Answers: 3

Business, 22.06.2019 21:00, alexis9658

Kendra knight took part in a friendly game of touch football. she had played before and was familiar with football. michael jewett was on her team. in the course of play, michael bumped into kendra and knocked her to the ground. he stepped on her hand, causing injury to a little finger that later required its amputation. she sued michael for damages. he defended on the ground that she had assumed the risk. kendra claimed that assumption of risk could not be raised as a defense because the state legislature had adopted the standard of comparative negligence. what happens if contributory negligence applies? what happens if the defense of comparative negligence applies?

Answers: 2

Business, 23.06.2019 00:40, pleasehelp5334me2

Oliver queen buys 100 shares of stock in green arrow archery corporation, a publicly traded company with which he is not affiliated as a director, officer, or employee. he then sells his 100 shares to john diggle. the sec sues oliver because he didn't register the sale of stock to john. who wins? oliver, because the sale falls into the nonissuer exemption oliver, because the sale falls into the private placement exemption the sec, because the transaction is not exempt from registration the sec, because even exempt transactions must be registered with the sec

Answers: 3

You know the right answer?

Olsen outfitters inc. believes that its optimal capital structure consists of 70% common equity and...

Questions in other subjects:

Chemistry, 07.01.2021 21:50

Health, 07.01.2021 21:50

History, 07.01.2021 21:50

Mathematics, 07.01.2021 21:50

Mathematics, 07.01.2021 21:50

Physics, 07.01.2021 21:50

Mathematics, 07.01.2021 21:50