Business, 23.10.2019 20:50 aroman4511

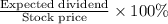

Walter utilities is a dividend-paying company and is expected to pay an annual dividend of $0.65 at the end of the year. its dividend is expected to grow at a constant rate of 9.50% per year. if walter’s stock currently trades for $12.00 per share, what is the expected rate of return? 954.95% 14.92% 921.67% 1,006.88%

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 20:30, genyjoannerubiera

The distinction between a normal and an inferior good is

Answers: 3

Business, 22.06.2019 22:50, esid906

Clooney corp. establishes a petty cash fund for $225 and issues a credit card to its office manager. by the end of the month, employees made one expenditure from the petty cash fund (entertainment, $20) and three expenditures with the credit card (postage, $59; delivery, $84; supplies expense, $49).record all employee expenditures, and record the entry to replenish the petty cash fund. the credit card balance will be paid later. (if no entry is required for a transaction/event, select "no journal entry required" in the first account record expenditures from credit card and the petty cash fund.

Answers: 2

You know the right answer?

Walter utilities is a dividend-paying company and is expected to pay an annual dividend of $0.65 at...

Questions in other subjects:

Mathematics, 17.07.2019 01:00

Mathematics, 17.07.2019 01:00

Mathematics, 17.07.2019 01:00

+ Growth rate

+ Growth rate + 9.50%

+ 9.50%