Business, 23.10.2019 04:50 lorraneb31

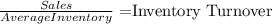

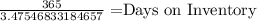

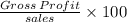

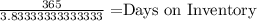

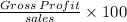

Current attempt in progress the following information is available for zoe’s activewear inc. for three recent fiscal years. 2022 2021 2020 inventory $553,000 $568,000 $332,000 net sales 1,948,000 1,725,000 1,311,000 cost of goods sold 1,552,000 1,288,000 947,000 (a) calculate the inventory turnover, days in inventory, and gross profit rate for 2022 and 2021. (round inventory turnover to 1 decimal place, e. g. 5.2, days in inventory to 0 decimal places, e. g. 125 and gross profit rate to 1 decimal place, e. g. 5.2%.) 2022 2021 inventory turnover enter an inventory turnover times enter an inventory turnover times days in inventory enter a number of days days enter a number of days days gross profit rate enter percentages % enter percentages % etextbook and media

Answers: 2

Other questions on the subject: Business

Business, 20.06.2019 18:04, firenation18

How much of your gross income should you spent on your rent and housing expenses

Answers: 3

Business, 21.06.2019 20:00, tiannaetzel

During 2017, sheridan company expected job no. 26 to cost $300000 of overhead, $500000 of materials, and $200000 in labor. sheridan applied overhead based on direct labor cost. actual production required an overhead cost of $260000, $510000 in materials used, and $150000 in labor. all of the goods were completed. what amount was transferred to finished goods?

Answers: 1

Business, 22.06.2019 07:50, sis212

Connors academy reported inventory in the 2017 year-end balance sheet, using the fifo method, as $154,000. in 2018, the company decided to change its inventory method to lifo. if the company had used the lifo method in 2017, the company estimates that ending inventory would have been in the range $130,000-$135,000. what adjustment would connors make for this change in inventory method?

Answers: 1

Business, 22.06.2019 18:50, gucc4836

Retirement investment advisors, inc., has just offered you an annual interest rate of 4.4 percent until you retire in 40 years. you believe that interest rates will increase over the next year and you would be offered 5 percent per year one year from today. if you plan to deposit $13,000 into the account either this year or next year, how much more will you have when you retire if you wait one year to make your deposit?

Answers: 3

You know the right answer?

Current attempt in progress the following information is available for zoe’s activewear inc. for thr...

Questions in other subjects:

Biology, 23.03.2020 05:03

History, 23.03.2020 05:03

History, 23.03.2020 05:04

Geography, 23.03.2020 05:04

Biology, 23.03.2020 05:04