Business, 19.10.2019 03:20 anavallesdemiguel2

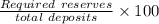

Suppose that from a new checkable deposit, first national bank holds two million dollars in vault cash, eight million dollars on deposit with the federal reserve, and one million dollars in required reserves. given this information, we can say first national bank faces a required reserve ratio of percent.

a) ten

b) twenty

c) eighty

d) ninety

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 19:20, BluSeaa

In 2007, americans smoked 19.2 billion packs of cigarettes. they paid an average retail price of $4.50 per pack. a. given that the elasticity of supply is 0.50.5 and the elasticity of demand is negative 0.4−0.4, derive linear demand and supply curves for cigarettes. the demand equation is qdequals=nothingplus+nothing times ×p and the supply equation is qsequals=nothingplus+nothing times ×p.

Answers: 2

Business, 21.06.2019 19:40, saggirl1209

Which of the following actions is most likely to result in a decrease in the money supply? a. the required reserve ratio for banks is decreased. b. the discount rate on overnight loans is lowered. c. the federal reserve bank buys treasury bonds. d. the government sells a new batch of treasury bonds. 2b2t

Answers: 1

Business, 22.06.2019 22:00, tannercarr3441

As a general rule, when accountants calculate profit they account for explicit costs but usually ignorea. certain outlays of money by the firm. b. implicit costs. c. operating costs. d. fixed costs.

Answers: 2

You know the right answer?

Suppose that from a new checkable deposit, first national bank holds two million dollars in vault ca...

Questions in other subjects:

Mathematics, 20.07.2019 00:40

Mathematics, 20.07.2019 00:40

History, 20.07.2019 00:40

Mathematics, 20.07.2019 00:40