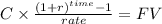

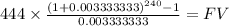

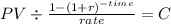

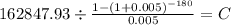

Taylor has a retirement account that pays 4% per year compounded monthly. every month for 20 years, taylor deposits $444, with the first deposit at the end of month 1. the day the last deposit is made, the interest rate increases to 6% per year compounded monthly. during retirement, taylor plans to make equal monthly withdrawals for 15 years, thus depleting the account. the first withdrawal occurs one month after the last deposit. how much can be withdrawn each month?

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 23:30, nicollexo21

San ruiz interiors provides design services to residential and commercial clients. the residential services produce a contribution margin of $450,000 and have traceable fixed operating costs of $480,000. management is studying whether to drop the residential operation. if closed, the fixed operating costs will fall by $370,000 and san ruiz’ income will

Answers: 3

Business, 22.06.2019 17:10, lerasteidl

To : of $25 up to 35 2 35 up to 45 5 45 up to 55 7 55 up to 65 20 65 up to 75 16 is$25 up to $35 ?

Answers: 1

Business, 22.06.2019 18:00, wirchakethan23

Match the different financial task to their corresponding financial life cycle phases

Answers: 3

You know the right answer?

Taylor has a retirement account that pays 4% per year compounded monthly. every month for 20 years,...

Questions in other subjects:

Mathematics, 25.11.2019 06:31

Physics, 25.11.2019 06:31

Social Studies, 25.11.2019 06:31

Social Studies, 25.11.2019 06:31