This problem has been solved!

see the answer

sellall department stores reported the fol...

This problem has been solved!

see the answer

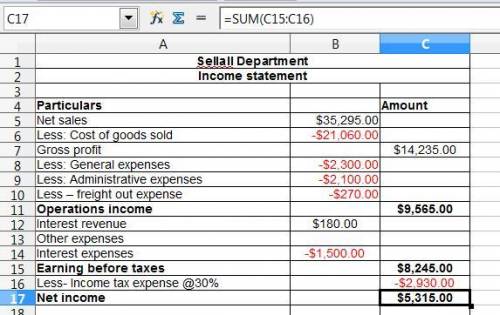

sellall department stores reported the following amounts in its adjusted trial balance prepared as of its december 31 year-end: administrative expenses, $2,100; cost of goods sold, $21,060; income tax expense, $2,930; interest expense, $1,500; interest revenue, $180; general expenses, $2,300; sales revenue, $39,000; sales discounts, $1,950; sales returns and allowances, $1,755; and delivery (freight-out) expense, $270.

prepare a multistep income statement for distribution to external financial statement users. fill in the blank and the rest of the table

sellall department stores

income statement

for the year ended december 31

cost of goods sold 21,060

gross profit

operating expenses 4,670

income from operations

interest revenue 180

income before income tax expense

net income $

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 15:00, jadejordan8888

When consumers discard their gasoline-powered automobiles for electric-powered ones, this partially reflects the of gasoline?

Answers: 1

Business, 21.06.2019 15:30, samiyahbass

What is "staffing level"? a) the practice of assigning the same number of workers to each department b) the average educational level attained by employees of a business c) the rank above cashier d) the number of workers assigned to jobs at a particular time

Answers: 2

Business, 21.06.2019 23:00, liluv5062

The impact fiscal multiplier is a. usually estimated to have an average value of 2. b. usually estimated to have an average value of 0. c. the actual immediate multiplier effect of a fiscal policy action after taking into consideration direct fiscal offsets and other short-term crowding out of private spending. d. the multiplier effect of a fiscal policy action that applies to a long-run period after all influences on equilibrium real gdp have been taken into account.

Answers: 3

Business, 22.06.2019 20:20, korireidkdotdot82021

Which of the following entries would be made to record the requisition of $12,000 of direct materials and $6,900 of indirect materials? (assume that indirect materials are included in raw materials inventory.) a. manufacturing overhead 18,900 raw materials inventory 18,900 b. wip inventory 12,000 manufacturing overhead 6,900 raw materials inventory 18,900 c. raw materials inventory 18,900 wip inventory 18,900 d. wip inventory 18,900 raw materials inventory 18,900

Answers: 1

You know the right answer?

Questions in other subjects:

Chemistry, 20.11.2020 22:20

Mathematics, 20.11.2020 22:20

Mathematics, 20.11.2020 22:20

Mathematics, 20.11.2020 22:20

Mathematics, 20.11.2020 22:20