Business, 18.10.2019 03:30 vinniemccray70

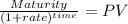

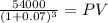

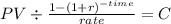

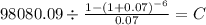

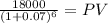

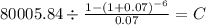

You can choose between machine a or b. your annual interest rate is 7%. you need a machine for 6 years (required service period). 1. machine a costs $54,000 and lasts for 3 years. it has no salvage value and costs an additional $18,000 each year to operate. 2. machine b costs $92,000 and lasts for 6 years. it has a salvage value of $18,000 and costs $13,000/year to operate. assume both machines can be purchased again for the same costs. what is the annual equivalent cost of the machine that you should purchase?

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 19:30, jluckie080117

In business, what would be the input, conversion and output of operating a summer band camp

Answers: 1

Business, 22.06.2019 15:00, darrengresham999

Match the terms with the appropriate definition. 1. work done for pay job 2. series of related jobs based on knowledge, training, tasks performed, interests, and experience career 3. buying or selling products and services using the internet mediation 4. wage amount after deductions are withheld net wage 5. a way a person chooses to live his or her life e-commerce 6. the people who are both able and willing to work technology 7. unequal treatment of others based on a bias concerning a person’s characteristics such as race, religion, gender, or age discrimination 8. the act of sharing information lifestyle 9. the use of a third party to make suggestions workforce 10. knowledge and tools used to perform tasks communication

Answers: 2

Business, 22.06.2019 16:40, michibabiee

Shawn received an e-mail offering a great deal on music, movie, and game downloads. he has never heard of the company, and the e-mail address and company name do not match. what should shawn do?

Answers: 2

Business, 22.06.2019 21:30, jefersonzoruajas

Which of the following best explains why online retail companies have an advantage over regular stores? a. their employees make less money because they mostly perform unskilled tasks. b. they are able to keep distribution costs low by negotiating deals with shipping companies. c. their transactions require expensive state-of-the-art technological devices. d. they have a larger number of potential customers because people anywhere can buy from them.

Answers: 1

You know the right answer?

You can choose between machine a or b. your annual interest rate is 7%. you need a machine for 6 yea...

Questions in other subjects:

Arts, 11.05.2021 18:50

Chemistry, 11.05.2021 18:50

Mathematics, 11.05.2021 18:50

Social Studies, 11.05.2021 18:50

English, 11.05.2021 18:50