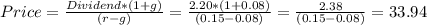

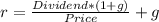

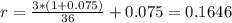

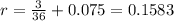

Your broker recommends that you purchase good mills at $30. the stock pays a $2.20 annual dividend, which (like its per share earnings) is expected to grow annually at 8 percent. if you want to earn 15 percent on your funds, is this stock a good buy and why? show your work. i do not want a simple yes or no answer. if you purchase large oil, inc. for $36 and the firm pays a $3.00 annual dividend which you expect to grow at 7.5 percent, what is the implied annual rate of return on your investment?

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 12:30, jamesleecy06

Recently, it was observed that people have started saving more rather than spending. this has impacted the demand for luxury goods and services. the decline in the demand led to unemployment in the related sectors. what can be a primary solution to reduce the unemployment levels in the country? a. increase the interest rates b. impose fine for savings c. force industries to rehire employees d. reduce the interest rates e. import goods and services

Answers: 3

Business, 21.06.2019 16:00, romet31

Danny "dimes" donahue is a neighborhood's 9-year-old entrepreneur. his most recent venture is selling homemade brownies that he bakes himself. at a price of $2 each, he sells 100. at a price of $1.5 each, he sells 300. instructions: round your answer to 1 decimal place. a. what is the elasticity of demand? 3.50 â± 0.1 . b. is demand elastic or inelastic over this price range? . c. if demand had the same elasticity for a price decline from $1.5 to $1 as it does for the decline from $2 to $1.5, would cutting the price from $1.5 to $1 increase or decrease danny's total revenue? .

Answers: 1

Business, 21.06.2019 20:30, gtamods402

What does the phrase limited liability mean in a corporate context?

Answers: 2

Business, 22.06.2019 00:30, juicyx39

Norton manufacturing expects to produce 2,900 units in january and 3,600 units in february. norton budgets $20 per unit for direct materials. indirect materials are insignificant and not considered for budgeting purposes. the balance in the raw materials inventory account (all direct materials) on january 1 is $38,650. norton desires the ending balance in raw materials inventory to be 10% of the next month's direct materials needed for production. desired ending balance for february is $51,100. what is the cost of budgeted purchases of direct materials needed for january? $58,000 $65,200 $26,550 $25,150

Answers: 1

You know the right answer?

Your broker recommends that you purchase good mills at $30. the stock pays a $2.20 annual dividend,...

Questions in other subjects:

Biology, 08.10.2019 13:30