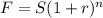

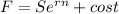

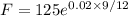

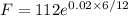

Suppose you enter into a 9-month long forward contract on a non-dividend-paying stock when the stock price is s0 = $125 and the risk-free rate is 2.0% per annum with continuous compounding. (a) what are the forward price (f0) and the initial value of the forward contract? (b) three months later, the price of the stock (s0) is $112, and the risk-free remains 2.0%. what are the forward price (f0) and the value of the forward contract? (c) another month later (4 months from today), the risk-free rate increases to 2.25% while the stock price stays $112.

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 00:30, 4300404440

Which statement is true about the elements of the interface of a presentation program? a. the status bar appears at the top of the page and displays options to style your slides. b. the tool bar displays the thumbnails of your presentation slides in the order they will appear in the presentation. c. rulers indicate the margins, tabs, and indents in a presentation slide. d. the document area provides a list of commands to create, format, and edit presentations.

Answers: 3

Business, 22.06.2019 02:00, whatistheinternetpas

True or false: a smart store layout moves customers in and out as fast as possible. a) true b) false

Answers: 2

Business, 22.06.2019 03:30, dontworry48

Lo.2, 3, 9 lori, who is single, purchased 5-years class property for $200,00 and 7-years class property for $420,000 on may 20, 2018. lori experts the taxable income derived form the business (without regard to the amount expensed under ⧠179) to be about $550,000. lori has determined that she should elect immediate ⧠179 expensing in the amount of $520,000, but she doesn’t know which asset she should completely expense under ⧠179. she does not claim any available additional first-year depreciation. a. determine lori’s total cost recovery deduction if the ⧠179 expense is first taken with respect to the 5-year class asset. b. determine lori’s total cost recovery deduction if the ⧠179 expense is first taken with respect to the 7-year class asset. c. what is your advice for lori? d. assume that lori is in the 24% marginal tax bracket and that she uses ⧠179 on the 7-year asset. determine the present value of the tax savings from the depreciation deductions for both assets. see appendix g for present value factors, and assume a 6% discount rate. e. assume the same facts as in part (d), except that lori decides not to use ⧠179 on either asset. determine the present value of the tax savings under this choice. in addition, determine which option lori should choose. f. present your solution to parts (d) and (e) of the problem in a spreadsheet using appropriate microsoft excel formulas. e-mail your spreadsheet to your instructor with a two-paragraph summary of your findings.

Answers: 1

Business, 22.06.2019 08:40, jasonr182017

During january 2018, the following transactions occur: january 1 purchase equipment for $20,600. the company estimates a residual value of $2,600 and a five-year service life. january 4 pay cash on accounts payable, $10,600. january 8 purchase additional inventory on account, $93,900. january 15 receive cash on accounts receivable, $23,100 january 19 pay cash for salaries, $30,900. january 28 pay cash for january utilities, $17,600. january 30 firework sales for january total $231,000. all of these sales are on account. the cost of the units sold is $120,500. the following information is available on january 31, 2018. depreciation on the equipment for the month of january is calculated using the straight-line method. the company estimates future uncollectible accounts. at the end of january, considering the total ending balance of the accounts receivable account as shown on the general ledger tab, $4,100 is now past due (older than 90 days), while the remainder of the balance is current (less than 90 days old). the company estimates that 50% of the past due balance will be uncollectible and only 3% of the current balance will become uncollectible. record the estimated bad debt expense. accrued interest revenue on notes receivable for january. unpaid salaries at the end of january are $33,700. accrued income taxes at the end of january are $10,100

Answers: 2

You know the right answer?

Suppose you enter into a 9-month long forward contract on a non-dividend-paying stock when the stock...

Questions in other subjects:

History, 20.03.2020 17:08

Mathematics, 20.03.2020 17:08

Mathematics, 20.03.2020 17:09

Mathematics, 20.03.2020 17:09

Social Studies, 20.03.2020 17:09