Business, 16.10.2019 03:00 goldenarrow

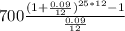

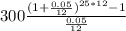

You are planning to save for retirement over the next 25 years. to do this, you will invest $700 per month in a stock account and $300 per month in a bond account. the return of the stock account is expected to be 9 percent, and the bond account will pay 5 percent. when you retire, you will combine your money into an account with a return of 6 percent. how much can you withdraw each month from your account assuming a 20-year withdrawal period?

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 18:00, kaitlynmoore42

You want to make an investment in a continuously compounding account over a period of two years. what interest rate is required for your investment to double in that time period? round the logarithm value and the answer to the nearest tenth.

Answers: 3

Business, 21.06.2019 22:30, indiareed0orv5ul

What two elements normally must exist before a person can be held liable for a crime

Answers: 1

Business, 22.06.2019 14:30, dabicvietboi

Which of the following is an example of a positive externality? a. promoting generic drugs would benefit people. b. a lower inflation rate would benefit most consumers. c. compulsory flu shots for all students prevents the spread of illness in the general public. d. singapore has adopted a comprehensive savings plan for all workers known as the central provident fund.

Answers: 1

Business, 22.06.2019 19:00, erbs2003

Which of the following would cause a shift to the right of the supply curve for gasoline? i. a large increase in the price of public transportation. ii. a large decrease in the price of automobiles. iii. a large reduction in the costs of producing gasoline

Answers: 1

You know the right answer?

You are planning to save for retirement over the next 25 years. to do this, you will invest $700 per...

Questions in other subjects:

English, 30.11.2020 22:20

Mathematics, 30.11.2020 22:20

Social Studies, 30.11.2020 22:20

Mathematics, 30.11.2020 22:20

English, 30.11.2020 22:20

...............1

...............1

...............2

...............2