Business, 10.10.2019 05:00 moneymaleia9264

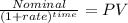

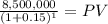

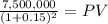

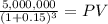

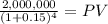

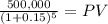

Carlisle enterprises, a specialty pharmaceutical manufacturer, has been losing market share for three years because several key patents have expired. free cash flow to the firm is expected to decline rapidly as more competitive generic drugs enter the market. projected cash flows for the next five years are $8.5 million, $7 million, $5 million, $2 million, and $0.5 million. cash flow after the fifth year is expected to be negligible. the firm’s board has decided to sell the firm to a larger pharmaceutical company that is interested in using carlisle’s product offering to fill gaps in its own product offering until it can develop similar drugs. carlisle’s weighted average cost of capital is 15%. what purchase price must carlisle obtain to earn its cost of capital?

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 10:30, highflylex279

Describe three scenarios in which you might utilize mathematics to investigate a crime scene, accident scene, or to make decisions involving police practice. be sure to explain how math is used in police as they work through each scenario.

Answers: 1

Business, 22.06.2019 17:00, staffordkimberly

Explain how can you avoid conflict by adjusting

Answers: 1

Business, 22.06.2019 19:10, sierravick123owr441

You have just been hired as a brand manager at kelsey-white, an american multinational consumer goods company. recently the firm invested in the development of k-w vision, a series of systems and processes that allow the use of up-to-date data and advanced analytics to drive informed decision making about k-w brands. it is 2018. the system is populated with 3 years of historical data. as brand manager for k-w’s blue laundry detergent, you are tasked to lead the brand's turnaround. use the vision platform to to develop your strategy and grow blue’s market share over the next 4 years.

Answers: 2

Business, 22.06.2019 19:50, hallkanay7398

Ichelle is attending college and has a part-time job. once she finishes college, michelle would like to relocate to a metropolitan area. she wants to build her savings so that she will have a "nest egg" to start her off. michelle works out her budget and decides she can afford to set aside $9090 per month for savings. her bank will pay her 4 %4% per year, compounded monthly, on her savings account. what will be michelle's balance in five years?

Answers: 3

You know the right answer?

Carlisle enterprises, a specialty pharmaceutical manufacturer, has been losing market share for thre...

Questions in other subjects:

English, 12.08.2021 15:40