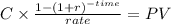

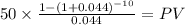

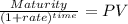

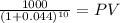

Kevin rogers is interested in buying a five-year bond that pays a coupon of 10 percent on a semiannual basis. the current market rate for similar bonds is 8.8 percent. what should be the current price of this bond? (do not round intermediate computations. round your final answer to the nearest dollar.)

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 20:00, lilakatedancer

To be able to better compare stock performance within the same industry, similar companies are grouped into? a)market sectors b) industry blocks c) performance sectors d) average earning blocks

Answers: 1

Business, 22.06.2019 09:00, episodegirl903

You speak to a business owner that is taking in almost $2000 in revenue each month. the owner still says that they are having trouble keeping the doors open. how can that be possible? use the terms of revenue, expenses and profit/loss in your answer

Answers: 3

Business, 22.06.2019 20:20, jennybee12331

Precision aviation had a profit margin of 6.25%, a total assets turnover of 1.5, and an equity multiplier of 1.8. what was the firm's roe? a. 15.23%b. 16.03%c. 16.88%d. 17.72%e. 18.60%

Answers: 2

You know the right answer?

Kevin rogers is interested in buying a five-year bond that pays a coupon of 10 percent on a semiannu...

Questions in other subjects:

Biology, 09.10.2020 08:01

Computers and Technology, 09.10.2020 08:01