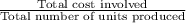

During its first year of operations, silverman company paid $12,240 for direct materials and $10,700 for production workers' wages. lease payments and utilities on the production facilities amounted to $9,700 while general, selling, and administrative expenses totaled $3,800. the company produced 6,800 units and sold 4,200 units at a price of $7.30 a unit. what is the amount of finished goods inventory on the balance sheet at year-end?

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 04:30, juliashalnev

The lee family is looking to buy a house in one of two suburban areas just outside of a major city, and air quality is a top priority for them. overall air quality is calculated by taking measures in 100 locations within each suburb and then calculating a measure of central tendency. in one suburb, there is a major bus station that creates very poor air quality at its location but has no impact in the surrounding parts of the suburb. in this situation, which measure of overall suburb air quality would be most useful?

Answers: 3

Business, 22.06.2019 16:30, AriaMartinez

Corrective action must be taken for a project when (a) actual progress to the planned progress shows the progress is ahead of schedule. (b) the technical specifications have been met. (c) the actual cost of the activities is less than the funds received for the work completed. (d) the actual progress is less than the planned progress.

Answers: 2

Business, 22.06.2019 19:30, mfkinnatz

Dollar shave club is an ecommerce start-up that delivers razors to its subscribers by mail. by doing this, dollar shave club is using a(n) to disrupt an existing market. a. innovation ecosystem b. architectural innovation c. business model innovation d. incremental innovation

Answers: 2

Business, 23.06.2019 17:00, oliviaciscooc

Flounder supply company, a newly formed corporation, incurred the following expenditures related to land, to buildings, and to machinery and equipment. abstract company’s fee for title search $1,066 architect’s fees 6,499 cash paid for land and dilapidated building thereon 178,350 removal of old building $41,000 less: salvage 11,275 29,725 interest on short-term loans during construction 15,170 excavation before construction for basement 38,950 machinery purchased (subject to 2% cash discount, which was not taken) 112,750 freight on machinery purchased 2,747 storage charges on machinery, necessitated by noncompletion of building when machinery was delivered 4,469 new building constructed (building construction took 6 months from date of purchase of land and old building) 994,250 assessment by city for drainage project 3,280 hauling charges for delivery of machinery from storage to new building 1,271 installation of machinery 4,100 trees, shrubs, and other landscaping after completion of building (permanent in nature) 11,070 instructions determine the amounts that should be debited to land, to buildings, and to machinery and equipment. assume the benefits of capitalizing interest during constructionexceed the cost of implementation. indicate how any costs notdebited to these accounts should be recorded.

Answers: 2

You know the right answer?

During its first year of operations, silverman company paid $12,240 for direct materials and $10,700...

Questions in other subjects:

Mathematics, 22.04.2020 01:36

Spanish, 22.04.2020 01:36

Chemistry, 22.04.2020 01:37

History, 22.04.2020 01:37

Mathematics, 22.04.2020 01:37

Mathematics, 22.04.2020 01:37