Business, 05.10.2019 01:10 TheHomieJaay3092

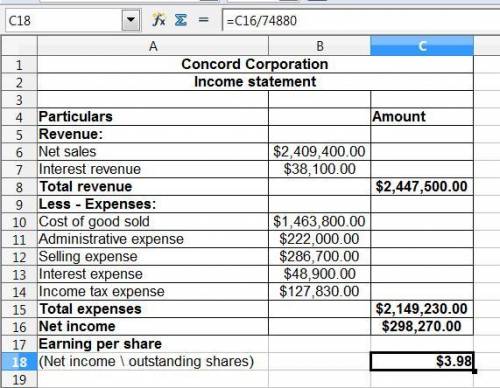

Concord corporation had net sales of $2,409,400 and interest revenue of $38,100 during 2020. expenses for 2020 were cost of goods sold $1,463,800, administrative expenses $222,000, selling expenses $286,700, and interest expense $48,900. concord’s tax rate is 30%. the corporation had 104,900 shares of common stock authorized and 74,880 shares issued and outstanding during 2020. prepare a single-step income statement for the year ended december 31, 2020. (round earnings per share to 2 decimal places, e. g. 1.48.)

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 12:50, tayjohn9774

Kendrick is leaving his current position at a company, and charlize is taking over. kendrick set up his powerpoint for easy access for himself. charlize needs to work in the program that is easy for her to use. charlize should reset advanced options

Answers: 3

Business, 22.06.2019 22:30, mayalp

Selected information about income statement accounts for the reed company is presented below (the company's fiscal year ends on december 31): 2018 2017sales $ 4,400,000 $ 3,500,000cost of goods sold 2,860,000 2,000,000administrative expenses 800,000 675,000selling expenses 360,000 312,000interest revenue 150,000 140,000interest expense 200,000 200,000loss on sale of assets of discontinued component 50,000 —on july 1, 2018, the company adopted a plan to discontinue a division that qualifies as a component of an entity as defined by gaap. the assets of the component were sold on september 30, 2018, for $50,000 less than their book value. results of operations for the component (included in the above account balances) were as follows: 1/1/18-9/30/18 2017 sales $ 400,000 $ 500,000 cost of goods sold (290,000 ) (320,000 )administrative expenses (50,000 ) (40,000 )selling expenses (20,000 ) (30,000 )operating income before taxes $ 40,000 $ 110,000 in addition to the account balances above, several events occurred during 2018 that have not yet been reflected in the above accounts: a fire caused $50,000 in uninsured damages to the main office building. the fire was considered to be an infrequent but not unusual event. inventory that had cost $40,000 had become obsolete because a competitor introduced a better product. the inventory was sold as scrap for $5,000.income taxes have not yet been recorded. required: prepare a multiple-step income statement for the reed company for 2018, showing 2017 information in comparative format, including income taxes computed at 40% and eps disclosures assuming 300,000 shares of common stock. (amounts to be deducted should be indicated with a minus sign. round eps answers to 2 decimal places.)

Answers: 3

Business, 23.06.2019 00:40, kate5582

Mesa company produces wooden rocking chairs. the company has two production departments, cutting and assembly. the wood is cut and sanded in cutting and then transferred to assembly to be assembled and painted. from assembly, the chairs are transferred to finished goods inventory and then are sold. mesa has compiled the following information for the month of february: cutting department assemblydepartmentdirect materials $ 73,000 $ 13,000direct labor 73,000 108,000applied manufacturing overhead 159,000 171,000cost of goods completed and transferred out 233,000 255,000required: 1, 2, 3, & 4. prepare journal entries for the transactions in the cutting and assembly departments of mesa company. (if no entry is required for a transaction/event, select "no journal entry required" in the first account field.)

Answers: 3

Business, 23.06.2019 02:10, yaniravivas79

Which of the following most accurately describes how the equilibrium price of a good or service can be determined? a. by moving the supply curve right or left until it matches the demand curve. b. by finding where the supply curve and the demand curve intersect. c. by doing market research to determine the maximum price consumers will pay. d. by taking the opposite of the columns in a supply schedule and a demand schedule.

Answers: 2

You know the right answer?

Concord corporation had net sales of $2,409,400 and interest revenue of $38,100 during 2020. expense...

Questions in other subjects:

Social Studies, 23.04.2021 19:00

Mathematics, 23.04.2021 19:00

Mathematics, 23.04.2021 19:00

Mathematics, 23.04.2021 19:00

Chemistry, 23.04.2021 19:00

Computers and Technology, 23.04.2021 19:00

Mathematics, 23.04.2021 19:00