Business, 04.10.2019 22:10 dootdootkazoot

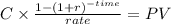

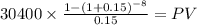

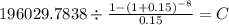

50-kilowatt gas turbine has an investment cost of $57,000. the operation and maintenance expense for this turbine is $400 per year. additionally, the hourly fuel expense for running the turbine is $7.50 per hour, and the turbine is expected to operate 4,000 hours each year. the cost of dismantling and disposing of the turbine at the end of its 8-year life is $8,000. if the marr is 15% per year, what is the annual equivalent life-cycle cost of the gas turbine? only fill in the number of your calculated result in the blank, e. g., if the result is $100, fill in "100"; also round to the nearest integer. note "cost" should be a negative number.

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 16:00, zavej400

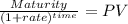

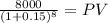

Navel county choppers, inc., is experiencing rapid growth. the company expects dividends to grow at 19 percent per year for the next 8 years before leveling off at 5 percent into perpetuity. the required return on the company’s stock is 10 percent. if the dividend per share just paid was $1.52, what is the stock price?

Answers: 2

Business, 23.06.2019 11:00, ellarsteers

The average month end closing stock price for company a over the past year is $34.57 with a standard deviation of $4.65. the average month end closing stock price for company b over the same period is $26.15 with a standard deviation of $7.45. based on this data, we can conclude that the stock price for company a is more consistent when compared to the stock price for company b.

Answers: 3

Business, 23.06.2019 15:00, kobiemajak

Alamar petroleum company offers its employees the option of contributing retirement funds up to 5% of their wages or salaries, with the contribution being matched by alamar. the company also pays 80% of medical and life insurance premiums. deductions relating to these plans and other payroll information for the first biweekly payroll period of february are listed as follows: wages and salaries $ 2,800,000 employee contribution to voluntary retirement plan 92,000 medical insurance premiums 50,000 life insurance premiums 9,800 federal income taxes to be withheld 480,000 local income taxes to be withheld 61,000 payroll taxes: federal unemployment tax rate 0.60 % state unemployment tax rate (after futa deduction) 5.40 % social security tax rate 6.20 % medicare tax rate 1.45 % required: prepare the appropriate journal entries to record salaries and wages expense and payroll tax expense for the biweekly pay period. assume that no employee's cumulative wages exceed the relevant wage bases for social security, and that all employees' cumulative wages do exceed the relevant unemployment wage bases.

Answers: 3

You know the right answer?

50-kilowatt gas turbine has an investment cost of $57,000. the operation and maintenance expense for...

Questions in other subjects:

Physics, 16.04.2021 15:20

Mathematics, 16.04.2021 15:20

Mathematics, 16.04.2021 15:20

Mathematics, 16.04.2021 15:20

Mathematics, 16.04.2021 15:20