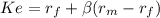

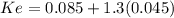

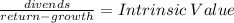

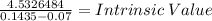

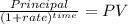

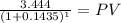

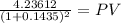

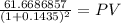

Acompany currently pays a dividend of $2.8 per share (d0 = $2.8). it is estimated that the company's dividend will grow at a rate of 23% per year for the next 2 years, and then at a constant rate of 7% thereafter. the company's stock has a beta of 1.3, the risk-free rate is 8.5%, and the market risk premium is 4.5%. what is your estimate of the stock's current price? do not round intermediate calculations. round your answer to the nearest cent.

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 21:20, khalilh1206

Vital industries manufactured 2 comma 200 units of its product huge in the month of april. it incurred a total cost of $ 121 comma 000 during the month. out of this $ 121 comma 000, $ 46 comma 000 comprised of direct materials used in the product and the rest was incurred because of the conversion cost involved in the process. ryan had no opening or closing inventory. what will be the total cost per unit of the product, assuming conversion costs contained $ 10 comma 900 of indirect labor?

Answers: 1

Business, 22.06.2019 12:30, sloane50

land, a building and equipment are acquired for a lump sum of $ 1,000,000. the market values of the land, building and equipment are $ 300,000, $ 800,000 and $ 300,000, respectively. what is the cost assigned to the equipment? (do not round any intermediary calculations, and round your final answer to the nearest dollar.)

Answers: 1

Business, 22.06.2019 14:00, breana758

Bayside coatings company purchased waterproofing equipment on january 2, 20y4, for $190,000. the equipment was expected to have a useful life of four years and a residual value of $9,000. instructions: determine the amount of depreciation expense for the years ended december 31, 20y4, 20y5, 20y6, and 20y7, by (a) the straight-line method and (b) the double-declining-balance method. also determine the total depreciation expense for the four years by each method. depreciation expense year straight-line method double-declining-balance method 20y4 $ $ 20y5 20y6 20y7 total $

Answers: 3

Business, 22.06.2019 19:20, goofy44

Royal motor corp. generates a major portion of its revenues by manufacturing luxury sports cars. however, the company also derives an insignificant percent of its annual revenues by selling its sports merchandise that includes apparel, shoes, and other accessories under the same brand name. which of the following terms best describes royal motor corp.? a. aconglomerate b. a subsidiary c. adominant-businessfirm d. a single-business firm

Answers: 1

You know the right answer?

Acompany currently pays a dividend of $2.8 per share (d0 = $2.8). it is estimated that the company's...

Questions in other subjects:

Advanced Placement (AP), 14.09.2021 14:30

Advanced Placement (AP), 14.09.2021 14:30

Mathematics, 14.09.2021 14:30

Chemistry, 14.09.2021 14:30