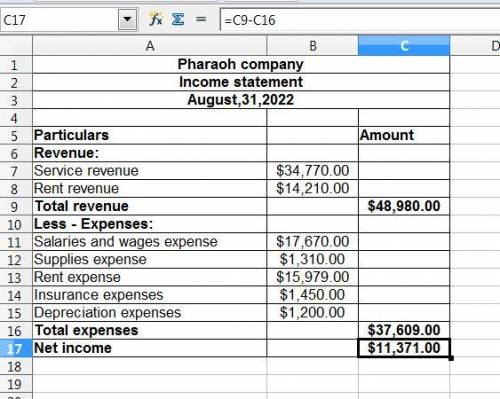

The adjusted trial balance for pharoah company is given below: pharoah company trial balance august 31, 2022 before adjustment after adjustment dr. cr. dr. cr. cash $11,540 $11,540 accounts receivable 8,570 9,220 supplies 2,500 1,190 prepaid insurance 4,270 2,820 equipment 16,840 16,840 accumulated depreciation—equipment $3,789 $4,989 accounts payable 5,460 5,460 salaries and wages payable 0 1,440 unearned rent revenue 1,870 1,020 common stock 14,260 14,260 retained earnings 5,570 5,570 dividends 2,500 2,500 service revenue 34,120 34,770 rent revenue 13,360 14,210 salaries and wages expense 16,230 17,670 supplies expense 0 1,310 rent expense 15,979 15,979 insurance expense 0 1,450 depreciation expense 0 1,200 $78,429 $78,429 $81,719 $81,719 prepare the income statement for the year ended august 31.

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 14:40, LlayahHarbin

Which one of the following is a characteristic of a jit partnership? a. frequent deliveries in large lot quantities b. removal of incoming inspection c. third-party logistics never used d. maximal product specifications imposed on supplier e. active pursuit of vertical integration

Answers: 3

Business, 22.06.2019 19:00, karmaxnagisa20

By 2020, automobile market analysts expect that the demand for electric autos will increase as buyers become more familiar with the technology. however, the costs of producing electric autos may increase because of higher costs for inputs (e. g., rare earth elements), or they may decrease as the manufacturers learn better assembly methods (i. e., learning by doing). what is the expected impact of these changes on the equilibrium price and quantity for electric autos?

Answers: 1

Business, 22.06.2019 19:30, brianna218208

He moto hotel opened for business on may 1, 2017. here is its trial balance before adjustment on may 31. moto hotel trial balance may 31, 2017 debit credit cash $ 2,283 supplies 2,600 prepaid insurance 1,800 land 14,783 buildings 72,400 equipment 16,800 accounts payable $ 4,483 unearned rent revenue 3,300 mortgage payable 38,400 common stock 59,783 rent revenue 9,000 salaries and wages expense 3,000 utilities expense 800 advertising expense 500 $114,966 $114,966 other data: 1. insurance expires at the rate of $360 per month. 2. a count of supplies shows $1,050 of unused supplies on may 31. 3. (a) annual depreciation is $2,760 on the building. (b) annual depreciation is $2,160 on equipment. 4. the mortgage interest rate is 5%. (the mortgage was taken out on may 1.) 5. unearned rent of $2,580 has been earned. 6. salaries of $810 are accrued and unpaid at may 31

Answers: 2

You know the right answer?

The adjusted trial balance for pharoah company is given below: pharoah company trial balance august...

Questions in other subjects:

Chemistry, 03.12.2020 14:00

Chemistry, 03.12.2020 14:00

Mathematics, 03.12.2020 14:00

English, 03.12.2020 14:00

Business, 03.12.2020 14:00

Social Studies, 03.12.2020 14:00

Mathematics, 03.12.2020 14:00