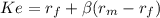

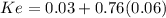

Ashare of stock with a beta of 0.76 now sells for $51. investors expect the stock to pay a year-end dividend of $3. the t-bill rate is 3%, and the market risk premium is 6%. if the stock is perceived to be fairly priced today, what must be investors’ expectation of the price of the stock at the end of the year? (do not round intermediate calculations. round your answer to 2 decimal places.)

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 16:10, olly09

The following are line items from the horizontal analysis of an income statement:increase/ (decrease) increase/ (decrease) 2017 2016 amount percent fees earned $120,000 $100,000 $20,000 20% wages expense 50,000 40,000 10,000 25 supplies expense 2,000 1,700 300 15 which of the items is stated incorrectly? a. fees earned b. supplies expense c. none of these choices are correct. d. wages expense

Answers: 3

Business, 23.06.2019 12:40, parkerfreeze

Discretionary spending: $450 per month new car insurance: $175 per month gas: $100 per month used car insurance: $125 per month gas: $100 per month according to your research, you need to budgetfor insurance and gasoline if you choose to buy or lease the new car. if you choose to buy the used car, you need to budget for insurance and gas.

Answers: 3

You know the right answer?

Ashare of stock with a beta of 0.76 now sells for $51. investors expect the stock to pay a year-end...

Questions in other subjects:

Mathematics, 02.03.2021 18:10

History, 02.03.2021 18:10

Mathematics, 02.03.2021 18:10

Biology, 02.03.2021 18:10

Mathematics, 02.03.2021 18:10

Social Studies, 02.03.2021 18:10

Mathematics, 02.03.2021 18:10

Mathematics, 02.03.2021 18:10