Business, 26.09.2019 19:10 EBeast7390

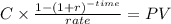

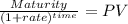

Assume that you wish to purchase a bond with a 30-year maturity, an annual coupon rate of 10 percent, a face value of $1,000, and semiannual interest payments. if you require a 9 percent nominal yield to maturity on this investment, what is the maximum price you should be willing to pay for the bond?

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 16:00, Virnalis1112

Which type of investment offers both capital gains and interest income? a. property b. cds c. stocks d. bonds

Answers: 2

Business, 22.06.2019 04:00, hahalol123goaway

Which law would encourage more people to become homeowners but not encourage risky loans that could end in foreclosure? options: offering first time homebuyers tax-free accounts to save for down payments requiring all mortgages to be more affordable, interest-only loans outlawing home inspections and appraisals by mortgage companies limiting rent increases to less than 2% a year

Answers: 2

Business, 22.06.2019 09:30, bubbagumpshrimpboy

When you hire an independent contractor you don't have to pay the contractors what

Answers: 3

Business, 22.06.2019 12:10, lucyamine0

Compute the cost of not taking the following cash discounts. (use a 360-day year. do not round intermediate calculations. input your final answers as a percent rounded to 2 decimal places.)

Answers: 1

You know the right answer?

Assume that you wish to purchase a bond with a 30-year maturity, an annual coupon rate of 10 percent...

Questions in other subjects:

History, 12.07.2019 19:40

Mathematics, 12.07.2019 19:40

Mathematics, 12.07.2019 19:40

Spanish, 12.07.2019 19:40