Business, 26.09.2019 19:10 diangeloortiz

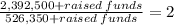

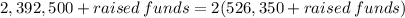

The stewart company has $2,392,500 in current assets and $1,076,625 in current liabilities. its initial inventory level is $526,350, and it will raise funds as additional notes payable and use them to increase inventory. how much can its short-term debt (notes payable) increase without pushing its current ratio below 2.0?

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 05:00, grangian06

Personal financial planning is the process of creating and achieving financial goals? true or false

Answers: 1

Business, 22.06.2019 08:30, shauntleaning

Match the given situations to the type of risks that a business may face while taking credit. 1. beta ltd. had taken a loan from a bank for a period of 15 years, but its sales are gradually showing a decline. 2. alpha ltd. has taken a loan for increasing its production and sales, but it has not conducted any research before making this decision. 3. delphi ltd. has an overseas client. the economy of the client’s country is going through severe recession. 4. delphi ltd. has taken a short-term loan from the bank, but its supply chain logistics are not in place. a. foreign exchange risk b. operational risk c. term of loan risk d. revenue projections risk

Answers: 3

You know the right answer?

The stewart company has $2,392,500 in current assets and $1,076,625 in current liabilities. its init...

Questions in other subjects:

Health, 03.08.2019 22:30

History, 03.08.2019 22:30

Social Studies, 03.08.2019 22:30

History, 03.08.2019 22:30

Biology, 03.08.2019 22:30

History, 03.08.2019 22:30

Biology, 03.08.2019 22:30

History, 03.08.2019 22:30