Business, 23.09.2019 20:30 taylorbug6161

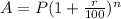

Robert white will receive cash flows of $4,450, $4,775, and $5,125from his investment. if he can earn 7 percent on any investment that he makes, what is the future value of his investment cash flows at the end of three years? (round to the nearest dollar.)

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 16:10, lalaboooobooo

Acustomer has come to your department with an urgent question. you promised her that you would collect information about her question and answer it by noon. it will take you at least 20 minutes to gather the information needed to provide an answer. it is now 11: 50 a. m. your supervisor just scheduled a 30-minute meeting to start at noon. this meeting is for all employees in your department. you decide to:

Answers: 2

Business, 21.06.2019 17:20, pauliavargas4184

Which of the following is a disadvantage of equity alliances when compared to non-equity alliances? 1. they are reflective of weaker ties between firms.2. they do not permit the exchange of explicit knowledge.3. they are more likely to bring about lack of trust and commitment.4. they require significantly higher levels of investment.

Answers: 2

Business, 22.06.2019 03:30, jose0765678755

Joe finally found a house for sale that he liked. which factor could increase the price of the house he likes? a. both he and the seller each have a real estate agent. b. a home inspector finds faulty wiring in the house. c. the house has been for sale for almost a year. d. several buyers all want that same house.

Answers: 2

Business, 22.06.2019 05:00, leonidas117

Which of the following differentiates cost accounting and financial accounting? a. the primary users of cost accounting are the investors, whereas the primary users of financial accounting are the managers. b. cost accounting measures only the financial information related to the costs of acquiring fixed assets in an organization, whereas financial accounting measures financial and nonfinancial information of a company's business transactions. c. cost accounting measures information related to the costs of acquiring or using resources in an organization, whereas financial accounting measures a financial position of a company to investors, banks, and external parties. d. cost accounting deals with product design, production, and marketing strategies, whereas financial accounting deals mainly with pricing of the products.

Answers: 3

You know the right answer?

Robert white will receive cash flows of $4,450, $4,775, and $5,125from his investment. if he can ear...

Questions in other subjects:

Medicine, 19.08.2020 18:01

Mathematics, 19.08.2020 18:01

Social Studies, 19.08.2020 18:01