Business, 23.09.2019 18:20 666isabella666

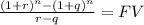

Your job pays you only once a year for all the work you did over the previous 12 months. today, december 31, you received your salary of $52,000 and you plan to spend all of it. however, you want to start saving for retirement beginning next year. you have decided that one year from today you will begin depositing 10 percent of your annual salary in an account that will earn 9.2 percent per year. your salary will increase at 3 percent per year throughout your career. how much money will you have on the date of your retirement 40 years from today? (do not round intermediate calculations and round your answer to 2 decimal places, e. g., 32.16.)

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 21:20, jovonjones1234

Kahn company's static budget was based on sales volume of 12,000 units. its flexible budget was based on sales volume of 14,000 units. based on this information multiple choice the sales volume variance is expected to be unfavorable. the materials cost volume variance is expected to be favorable. the labor cost volume variance is expected to be unfavorable. none of the answers is correct.

Answers: 3

Business, 22.06.2019 13:20, sailesd57

Last year, johnson mills had annual revenue of $37,800, cost of goods sold of $23,200, and administrative expenses of $6,300. the firm paid $700 in dividends and had a tax rate of 35 percent. the firm added $2,810 to retained earnings. the firm had no long-term debt. what was the depreciation expense?

Answers: 2

Business, 22.06.2019 19:00, jediDR

Tri fecta, a partnership, had revenues of $369,000 in its first year of operations. the partnership has not collected on $45,000 of its sales and still owes $39,500 on $155,000 of merchandise it purchased. there was no inventory on hand at the end of the year. the partnership paid $27,000 in salaries. the partners invested $48,000 in the business and $23,000 was borrowed on a five-year note. the partnership paid $2,070 in interest that was the amount owed for the year and paid $9,500 for a two-year insurance policy on the first day of business. compute net income for the first year for tri fecta.

Answers: 2

You know the right answer?

Your job pays you only once a year for all the work you did over the previous 12 months. today, dece...

Questions in other subjects:

English, 12.12.2021 18:00

Mathematics, 12.12.2021 18:00

Mathematics, 12.12.2021 18:00