Business, 23.09.2019 17:20 ramentome7542

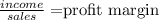

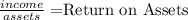

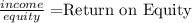

Wims, inc., has sales of $15.2 million, total assets of $9.8 million, and total debt of $3.7 million. the profit margin is 6 percent. a. what is net income? (do not round intermediate calculations and enter your answer in dollars, not millions, rounded to the nearest whole number, e. g., 1,234,567.) b. what is roa? (do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e. g., 32.16.) c. what is roe?

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 08:30, justalikri

Most angel investors expect a return on investment of question options: 20% to 25% over 5 years. 15% to 20% over 5 years. 75% over 10 years. 100% over 5 years.

Answers: 1

Business, 22.06.2019 15:20, sgalvis455

Abank has $132,000 in excess reserves and the required reserve ratio is 11 percent. this means the bank could have in checkable deposit liabilities and in (total) reserves.

Answers: 3

Business, 22.06.2019 16:40, yoooo9313

An electronics store is running a promotion where for every video game purchased, the customer receives a coupon upon checkout to purchase a second game at a 50% discount. the coupons expire in one year. the store normally recognized a gross profit margin of 40% of the selling price on video games. how would the store account for a purchase using the discount coupon?

Answers: 3

Business, 22.06.2019 19:10, boi7348

Pam is a low-risk careful driver and fran is a high-risk aggressive driver. to reveal their driver types, an auto-insurance company a. refuses to insure high-risk drivers b. charges a higher premium to owners of newer cars than to owners of older cars c. offers policies that enable drivers to reveal their private information d. uses a pooling equilibrium e. requires drivers to categorize themselves as high-risk or low-risk on the application form

Answers: 3

You know the right answer?

Wims, inc., has sales of $15.2 million, total assets of $9.8 million, and total debt of $3.7 million...

Questions in other subjects:

Chemistry, 11.07.2019 10:30

Physics, 11.07.2019 10:30

Biology, 11.07.2019 10:30

History, 11.07.2019 10:30

Spanish, 11.07.2019 10:30