Business, 18.09.2019 00:30 sarahabuadas7396

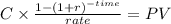

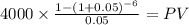

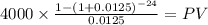

Calculate the present value of the following annuity streams: a. $4,000 received each year for 6 years on the last day of each year if your investments pay 5 percent compounded annually. b. $4,000 received each quarter for 6 years on the last day of each quarter if your investments pay 5 percent compounded quarterly. c. $4,000 received each year for 6 years on the first day of each year if your investments pay 5 percent compounded annually. d. $4,000 received each quarter for 6 years on the first day of each quarter if your investments pay 5 percent compounded quarterly. (for all requirements, do not round intermediate calculations. round your answers to 2 decimal places. (e. g., 32.16))

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 02:30, linaaaaa7

Consider how health insurance affects the quantity of health care services performed. suppose that the typical medical procedure has a cost of $160, yet a person with health insurance pays only $40 out of pocket. her insurance company pays the remaining $120. (the insurance company recoups the $120 through premiums, but the premium a person pays does not depend on how many procedures that person chooses to undergo.) consider the following demand curve in the market for medical care. use the black point (plus symbol) to indicate the quantity of procedures demanded if each procedure has a price of $160. then use the grey point (star symbol) to indicate the quantity of procedures demanded if each procedure has a price of $40. q d at p=$160 q d at p=$40 0 10 20 30 40 50 60 70 80 90 100 200 180 160 140 120 100 80 60 40 20 0 price of medical procedures quantity of medical procedures demand if the cost of each procedure to society is truly $160, the quantity that maximizes total surplus is procedures. economists often blame the health insurance system for excessive use of medical care. given your analysis, the use of care might be viewed as excessive because consumers get procedures whose value is than the cost of producing them.

Answers: 1

Business, 22.06.2019 23:00, terrickaimani

Investors who put their own money into a startup are known as a. mannequins b. obligators c. angels d. borrowers

Answers: 1

Business, 23.06.2019 03:00, marvin07

On december 31, 2016, the decarreau, andrew, and bui partnership had the following fiscal year-end balance sheet: cash $10,000accounts receivable $20,000inventory $25,000plant assets - net $30,000loan to decarreau $18,000total assets $103,000accounts payable $14,000loan from bui $15,000decarreaua, capital (20%) $32,000andrew, capital (10%) $23,000bui, capital (70%) $19,000total liab./equity $103,000the percentages shown are the residual profit and loss sharing ratios. the partners dissolved the partnership on january 1, 2017, and began the liquidation process. during july the following events occurred: * receivables of $18,000 were collected.* all inventory was sold for $15,000.*all available cash was distributed on january 31, except for$8,000 that was set aside for contingent expenses. the book value of the partnership equity (i. e., total equity of the partners) on december 31, 2016 isa. $58,000b. $71,000c. $66,000d. $81,000

Answers: 1

Business, 23.06.2019 07:00, Shamplo8817

Select all of the tools you could use to track your expenses. -budget software -spreadsheet -mint© -automatic bill payment -mvelopes®

Answers: 2

You know the right answer?

Calculate the present value of the following annuity streams: a. $4,000 received each year for 6 ye...

Questions in other subjects:

English, 04.02.2021 23:20

Social Studies, 04.02.2021 23:20

Social Studies, 04.02.2021 23:20

Mathematics, 04.02.2021 23:20

Mathematics, 04.02.2021 23:20

Mathematics, 04.02.2021 23:20

History, 04.02.2021 23:20

Mathematics, 04.02.2021 23:20