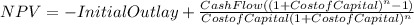

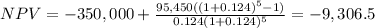

Crochetco is considering an investment in a project which would require an initial outlay of $350,000 and produce expected cash flows in years 1-5 of $95,450 per year. you have determined that the current after-tax cost of the firm's capital (required rate of return) for each source of financing is as follows: cost of long-term debt7%cost of preferred stock11%cost of commonstock15%long-term debt currently makes up 25% of the capital structure, preferred stock 15%, and common stock 60%. what is the net present value of this project? a) -$9,306b) $2,149c) $5,983d) $11,568

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 06:30, coralaguilar1702

73. calculate the weighted average cost of capital (wacc) based on the following information: the equity multiplier is 1.66; the interest rate on debt is 13%; the required return to equity holders is 22%; and the tax rate is 35%. (a) 15.6% (b) 16.0% (c) 15.0% (d) 16.6% (e) none of the above

Answers: 2

Business, 22.06.2019 13:30, drippyc334

What do you recommend adam do to increase production in a business setting that does not seem to value high productivity?

Answers: 3

Business, 22.06.2019 15:20, amulets5239

Sauer food company has decided to buy a new computer system with an expected life of three years. the cost is $440,000. the company can borrow $440,000 for three years at 14 percent annual interest or for one year at 12 percent annual interest. assume interest is paid in full at the end of each year. a. how much would sauer food company save in interest over the three-year life of the computer system if the one-year loan is utilized and the loan is rolled over (reborrowed) each year at the same 12 percent rate? compare this to the 14 percent three-year loan.

Answers: 3

Business, 22.06.2019 23:00, jcrowley9362

How is challah bread made? if i have to dabble the recipe?

Answers: 1

You know the right answer?

Crochetco is considering an investment in a project which would require an initial outlay of $350,00...

Questions in other subjects:

Mathematics, 29.06.2019 07:50

English, 29.06.2019 07:50

History, 29.06.2019 07:50

Mathematics, 29.06.2019 07:50

History, 29.06.2019 07:50

History, 29.06.2019 07:50