Business, 11.09.2019 01:30 zlittleton2008

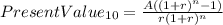

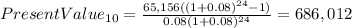

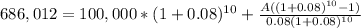

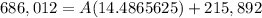

An individual is now 50 years old, that he plans to retire in 10 years, and that he expects to live for 25 years after he retires, that is, until he is 85. he wants a fixed annual retirement income of $65,156. his retirement income will begin the day he retires, 10 years from today, and he will then get 24 additional annual payments. he currently has $100,000 saved up; and he expects to earn a return on his savings of 8 percent per year, annual compounding. to the nearest dollar, how much must he save during each of the next 10 years (with deposits being made at the end of each year) to meet his retirement goal?

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 08:30, franstirlacci

Uppose that the federal reserve purchases a bond for $100,000 from donald truck, who deposits the proceeds in the manufacturer’s national bank. what will be the impact of this purchase on the supply of money? the money supply will increase by $100,000. the money supply will increase by $80,000. the money supply will increase by $500,000. this action will have no effect on the money supply. if the reserve requirement ratio is 20 percent, what is the maximum amount of additional loans that the manufacturer’s bank will be able to extend as the result of truck’s deposit? the maximum additional loans is $100,000. the maximum additional loans is $80,000. the maximum additional loans is $20,000. the maximum additional loans is $500,000. given the 20 percent reserve requirement, what is the maximum increase in the quantity of checkable deposits that could result throughout the entire banking system because of the fed’s action? this action will have no effect on the money supply. the money supply will eventually increase by $80,000. the money supply will eventually increase by $500,000. the money supply will eventually increase by $100,000.

Answers: 1

Business, 22.06.2019 20:30, boog89

Mordica company identifies three activities in its manufacturing process: machine setups, machining, and inspections. estimated annual overhead cost for each activity is $156,960, $382,800, and $84,640, respectively. the cost driver for each activity and the expected annual usage are number of setups 2,180, machine hours 25,520, and number of inspections 1,840. compute the overhead rate for each activity. machine setups $ per setup machining $ per machine hour inspections $ per inspection

Answers: 1

Business, 22.06.2019 21:00, mattsucre1823

Suppose either computers or televisions can be assembled with the following labor inputs: units produced 1 2 3 4 5 6 7 8 9 10 total labor used 3 7 12 18 25 33 42 54 70 90 (a) draw the production possibilities curve for an economy with 54 units of labor. label it p54. (b) what is the opportunity cost of the eighth computer? (c) suppose immigration brings in 36 more workers. redraw the production possibilities curve to reflect this added labor. label the new curve p90.

Answers: 2

Business, 22.06.2019 22:10, jeanieb

Consider the labor market for computer programmers. during the late 1990s, the value of the marginal product of all computer programmers increased dramatically. holding all else equal, what effect did this process have on the labor market for computer programmers? the equilibrium wagea. increased, and the equilibrium quantity of labor decreased. b. decreased, and the equilibrium quantity of labor increased. c. increased, and the equilibrium quantity of labor increased. d. decreased, and the equilibrium quantity of labor decreased.

Answers: 3

You know the right answer?

An individual is now 50 years old, that he plans to retire in 10 years, and that he expects to live...

Questions in other subjects:

Biology, 23.12.2020 09:10

Spanish, 23.12.2020 09:10

Mathematics, 23.12.2020 09:10

Arts, 23.12.2020 09:10

Mathematics, 23.12.2020 09:10