Business, 11.09.2019 00:20 hannahs1313

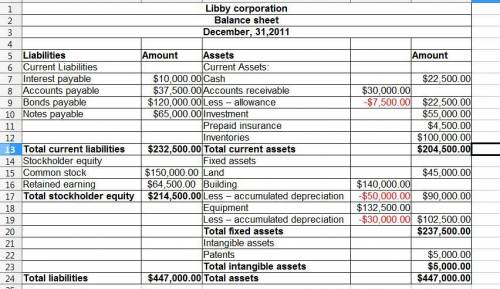

The december 31, 2011, post closing trial balance in thousands for libby corporations is preseted below

debit credit

cash 22,500

investments 55,000

accouts recievable 30,000

allownnce for uncollectible accounts 7,500

prepaid insurance 4,500

inventories 100,000

land 45,000

buildings 140,000

accumulated depreciation-buildings 50,000

equipment 132,500

accumulated depreciation-equipment 30,000

patents(unamortized balance) 5,000

accounts payable 37,500

notes payable, due 2012 65,000

interest payable 10,000

bonds payable due 2021 120,000

common stock 150,000

retained earnings 64,500

total 534,500 534,500

prepare a classified balance sheet for libby corporation at december 31,2011

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 07:10, mega29

1. the healthy pantry bought new shelving and financed $7,300 with 36 monthly payments of $267.65 each. suppose the firm pays the loan off with 13 payments left. use the rule of 78 to find the amount of unearned interest. 2. the healthy pantry bought new shelving and financed $7,300 with 36 monthly payments of $267.65 each. suppose the firm pays the loan off with 13 payments left. use the rule of 78 to find the amount necessary to pay off the loan. ! i entered 967.82 for question 1 and 5,455.78 for question 2 and it said it was

Answers: 3

Business, 22.06.2019 21:40, summerhumphries3

Engberg company installs lawn sod in home yards. the company’s most recent monthly contribution format income statement follows: amount percent of sales sales $ 80,000 100% variable expenses 32,000 40% contribution margin 48,000 60% fixed expenses 38,000 net operating income $ 10,000 required: 1. compute the company’s degree of operating leverage. (round your answer to 1 decimal place.) 2. using the degree of operating leverage, estimate the impact on net operating income of a 5% increase in sales. (do not round intermediate calculations.) 3. construct a new contribution format income statement for the company assuming a 5% increase in sales.

Answers: 3

Business, 22.06.2019 22:20, Shubbs

Which of the following is one disadvantage of renting a place to live compared to buying a home? a. tenants have to pay for all repairs to the building. b. the landlord covers the expenses of maintaining the property. c. residents can't alter their living space without permission. d. rent is generally more than monthly mortgage payments.

Answers: 1

Business, 23.06.2019 02:00, christiannpettyy

Donna and gary are involved in an automobile accident. gary initiates a lawsuit against donna by filing a complaint. if donna files a motion to dismiss, she is asserting that

Answers: 1

You know the right answer?

The december 31, 2011, post closing trial balance in thousands for libby corporations is preseted be...

Questions in other subjects:

Mathematics, 13.10.2020 17:01

History, 13.10.2020 17:01

Mathematics, 13.10.2020 17:01

Mathematics, 13.10.2020 17:01

Physics, 13.10.2020 17:01

Arts, 13.10.2020 17:01