Business, 10.09.2019 22:30 jessemartinez1

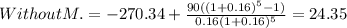

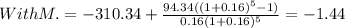

Nelectric utility is considering a new power plant in northern arizona. power from the plant would be sold in the phoenix area, where it is badly needed. because the firm has received a permit, the plant would be legal; but it would cause some air pollution. the company could spend an additional $40 million at year 0 to mitigate the environmental problem, but it would not be required to do so. the plant without mitigation would cost $270.34 million, and the expected cash inflows would be $90 million per year for 5 years. if the firm does invest in mitigation, the annual inflows would be $94.34 million. unemployment in the area where the plant would be built is high, and the plant would provide about 350 good jobs. the risk adjusted wacc is 16%. calculate the npv and irr with mitigation. round your answers to two decimal places. enter your answer for npv in millions. for example, an answer of $10,550,000 should be entered as 10.55. npv $ million irr % calculate the npv and irr without mitigation. round your answers to two decimal places. enter your answer for npv in millions. for example, an answer of $10,550,000 should be entered as 10.55. npv $ million irr %

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 08:40, kamarionnatillman13

The following selected circumstances relate to pending lawsuits for erismus, inc. erismus’s fiscal year ends on december 31. financial statements are issued in march 2019. erismus prepares its financial statements according to u. s. gaap. required: indicate the amount erismus would record as an asset, liability, or not accrued in the following circumstances. 1. erismus is defending against a lawsuit. erismus's management believes the company has a slightly worse than 50/50 chance of eventually prevailing in court, and that if it loses, the judgment will be $1,000,000. 2. erismus is defending against a lawsuit. erismus's management believes it is probable that the company will lose in court. if it loses, management believes that damages could fall anywhere in the range of $2,000,000 to $4,000,000, with any damage in that range equally likely. 3. erismus is defending against a lawsuit. erismus's management believes it is probable that the company will lose in court. if it loses, management believes that damages will eventually be $5,000,000, with a present value of $3,500,000. 4. erismus is a plaintiff in a lawsuit. erismus's management believes it is probable that the company eventually will prevail in court, and that if it prevails, the judgment will be $1,000,000. 5. erismus is a plaintiff in a lawsuit. erismus’s management believes it is virtually certain that the company eventually will prevail in court, and that if it prevails, the judgment will be $500,000.

Answers: 1

Business, 22.06.2019 11:00, pum9roseslump

While on vacation in las vegas jennifer, who is from utah, wins a progressive jackpot playing cards worth $15,875 at the casino royale. what implication does she encounter when she goes to collect her prize?

Answers: 1

Business, 22.06.2019 14:30, 20guadalupee73248

The face of a company is often that of the lowest paid employees who meet the customers. select one: true false

Answers: 1

You know the right answer?

Nelectric utility is considering a new power plant in northern arizona. power from the plant would b...

Questions in other subjects:

Mathematics, 03.12.2021 20:30

English, 03.12.2021 20:30

Business, 03.12.2021 20:30

French, 03.12.2021 20:30

Spanish, 03.12.2021 20:30