Business, 10.09.2019 18:30 elizabethhubbe

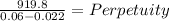

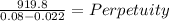

Creating an endowment personal finance problem on completion of her introductory finance course, marla lee was so with the amount of useful and interesting knowledge she gained that she convinced her parents, who were wealthy alumni of the university she was attending, to create an endowment. the endowment will provide for three students from low-income families to take the introductory finance course each year in perpetuity. the cost of taking the finance course this year is $300 per student (or $900 for 3 students), but that cost will grow by 2.2% per year forever. marla's parents will create the endowment by making a single payment to the university today. the university expects to earn 6% per year on these funds. a. what will it cost 3 students to take the finance class next year? b. how much will marla's parents have to give the university today to fund the endowment if it starts paying out cash flow next year? c. what amount would be needed to fund the endowment if the university could earn 8% rather than 6% per year on the funds?

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 20:30, bale4

Which of the following best describes how the federal reserve bank banks during a bank run? a. the federal reserve bank regulates exchanges to prevent the demand for withdrawals from rising above the required reserve ratio. b. the federal reserve bank acts as an insurance company that pays customers if their bank fails. c. the federal reserve bank has the power to take over a private bank if customers demand too many withdrawals. d. the federal reserve bank can provide a short-term loan to banks to prevent them from running out of money. 2b2t

Answers: 2

Business, 22.06.2019 07:50, ShawnSaviro4918

In december of 2004, the company you own entered into a 20-year contract with a grain supplier for daily deliveries of grain to its hot dog bun manufacturing facility. the contract called for "10,000 pounds of grain" to be delivered to the facility at the price of $100,000 per day. until february 2017, the supplier provided processed grain which could easily be used in your manufacturing process. however, no longer wanting to absorb the cost of having the grain processed, the supplier began delivering whole grain. the supplier is arguing that the contract does not specify the type of grain that would be supplied and that it has not breached the contract. your company is arguing that the supplier has an onsite processing plant and processed grain was implicit to the terms of the contract. over the remaining term of the contract, reshipping and having the grain processed would cost your company approximately $10,000,000, opposed to a cost of around $1,000,000 to the supplier. after speaking with in-house counsel, it was estimated that litigation would cost the company several million dollars and last for years. weighing the costs of litigation, along with possible ambiguity in the contract, what are three options you could take to resolve the dispute? which would be the best option for your business and why?

Answers: 2

Business, 22.06.2019 14:30, kaylahill14211

You hear your supervisor tell another supervisor that a fire drill will take place later today when the fire alarm sounds that afternoon you should

Answers: 1

Business, 22.06.2019 15:20, byler47

Capital financial corporation will lend 90 percent against account balances that have averaged 30 days or less; 80 percent for account balances between 31 and 40 days; and 70 percent for account balances between 41 and 45 days. customers that take over 45 days to pay their bills are not considered acceptable accounts for a loan. the current prime rate is 16.50 percent, and capital charges 3.50 percent over prime to charming as its annual loan rate. a. determine the maximum loan for which charming paper company could qualify.

Answers: 1

You know the right answer?

Creating an endowment personal finance problem on completion of her introductory finance course, mar...

Questions in other subjects:

Mathematics, 14.07.2019 23:00

Computers and Technology, 14.07.2019 23:00

Mathematics, 14.07.2019 23:00

Biology, 14.07.2019 23:00

Mathematics, 14.07.2019 23:00