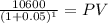

Pat pays $10,000 for a newly issued two-year government bond with a $10,000 face value and a 6 percent coupon rate. one year later, after receiving the first coupon payment, pat sells the bond. if the current one-year interest rate on government bonds is 5 percent, then the price pat receives is: a. $10,000.

b. $500.

c. greater than $10,000.

d. less than $10,000.

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 16:50, tayveon122

Identify and describe a variety of performance rating scales that can be used in organizations including graphical scales, letter scales, and numeric scales.

Answers: 2

Business, 22.06.2019 19:30, alejandra340

Adisadvantage of corporations is that shareholders have to pay on profits.

Answers: 1

Business, 22.06.2019 23:30, ameliaxbowen7

Rate of return douglas keel, a financial analyst for orange industries, wishes to estimate the rate of return for two similar-risk investments, x and y. douglas's research indicates that the immediate past returns will serve as reasonable estimates of future returns. a year earlier, investment x had a market value of $27 comma 000; and investment y had a market value of $46 comma 000. during the year, investment x generated cash flow of $2 comma 025 and investment y generated cash flow of $ 6 comma 770. the current market values of investments x and y are $28 comma 582 and $46 comma 000, respectively. a. calculate the expected rate of return on investments x and y using the most recent year's data. b. assuming that the two investments are equally risky, which one should douglas recommend? why?

Answers: 1

You know the right answer?

Pat pays $10,000 for a newly issued two-year government bond with a $10,000 face value and a 6 perce...

Questions in other subjects:

Arts, 04.03.2020 23:39