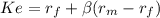

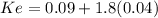

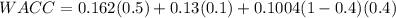

Gul corp. considers the following capital structure optimal: 40% debt; 50% equity; and 10% preferred stock. gul’s stock currently sells for $50 per share. gul’s beta is 1.8. the risk-free rate is 9 percent and the expected market return is 13 percent. gul’s bond currently sells in the market for $1150. the bond carries an annual coupon payment of 12 % of the face value which is paid in two semiannual payments. the bond will mature in 15 years and its face value is $1000. the bond's annual yield to maturiy is 10.04%. the firm’s marginal tax rate is 40 percent. the gul’s required return on the preferred stock is 13%. find the firm’s overall cost of capital (wacc).

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 08:30, hartzpeyton136

Match each item to check for while reconciling a bank account with the document to which it relates.(there's not just one answer)1. balancing account statement2. balancing check registera. nsf feesb. deposits in transitc. interest earnedd. bank errors

Answers: 2

Business, 22.06.2019 11:20, leshayellis1591

Lusk corporation produces and sells 14,300 units of product x each month. the selling price of product x is $25 per unit, and variable expenses are $19 per unit. a study has been made concerning whether product x should be discontinued. the study shows that $72,000 of the $102,000 in monthly fixed expenses charged to product x would not be avoidable even if the product was discontinued. if product x is discontinued, the annual financial advantage (disadvantage) for the company of eliminating this product should be:

Answers: 1

Business, 22.06.2019 19:00, Anonymouslizard

All of the following led to the collapse of the soviet economy except a. a lack of worker incentives. c. inadequate supply of consumer goods. b. a reliance on production quotas. d. the introduction of a market economy.

Answers: 1

Business, 22.06.2019 19:50, hallkanay7398

Ichelle is attending college and has a part-time job. once she finishes college, michelle would like to relocate to a metropolitan area. she wants to build her savings so that she will have a "nest egg" to start her off. michelle works out her budget and decides she can afford to set aside $9090 per month for savings. her bank will pay her 4 %4% per year, compounded monthly, on her savings account. what will be michelle's balance in five years?

Answers: 3

You know the right answer?

Gul corp. considers the following capital structure optimal: 40% debt; 50% equity; and 10% prefer...

Questions in other subjects:

Mathematics, 16.02.2021 22:20

Mathematics, 16.02.2021 22:20

Social Studies, 16.02.2021 22:20

Mathematics, 16.02.2021 22:20

Mathematics, 16.02.2021 22:20