Business, 05.09.2019 16:10 TatlTael7321

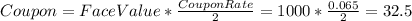

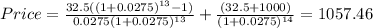

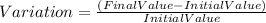

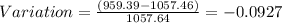

The corner grocer has a 7-year, 6.5 percent semiannual coupon bond outstanding with a $1,000 par value. the bond has a yield to maturity of 5.5 percent. which one of the following statements is correct if the market yield suddenly increases to 7.25 percent? a) the bond price will decrease by 9.27 percent. b) the bond price will increase by 3.86 percent. c) the bond price will decrease by 8.64 percent. d) the bond price will increase by 7.16 percent. e) the bond price will increase by 7.04 percent

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 01:00, fatty18

In order to gauge public opinion about how to handle iran's growing nuclear program, a research group surveyed 1010 americans by telephone and asked them to rate the threat iran's nuclear program poses to the world on a scale of 1 to 10. describe the population, sample, population parameters, and sample statistics. identify the population in the given problem. choose the correct answer below.

Answers: 2

Business, 22.06.2019 03:00, marahsenno

How could brian, who doesn't want his car insurance premiums to increase, show he poses a low risk to his insurance company? a: drive safely to avoid accidents and traffic citations b: wash and wax his car regularly to keep it clean c: allow unlicensed drivers to drive carelessly in his car d: incur driver's license points from breaking driving laws

Answers: 1

Business, 22.06.2019 11:50, 2kdragginppl

Stocks a, b, and c are similar in some respects: each has an expected return of 10% and a standard deviation of 25%. stocks a and b have returns that are independent of one another; i. e., their correlation coefficient, r, equals zero. stocks a and c have returns that are negatively correlated with one another; i. e., r is less than 0. portfolio ab is a portfolio with half of its money invested in stock a and half in stock b. portfolio ac is a portfolio with half of its money invested in stock a and half invested in stock c. which of the following statements is correct? a. portfolio ab has a standard deviation that is greater than 25%.b. portfolio ac has an expected return that is less than 10%.c. portfolio ac has a standard deviation that is less than 25%.d. portfolio ab has a standard deviation that is equal to 25%.e. portfolio ac has an expected return that is greater than 25%.

Answers: 3

You know the right answer?

The corner grocer has a 7-year, 6.5 percent semiannual coupon bond outstanding with a $1,000 par val...

Questions in other subjects:

Biology, 03.09.2021 16:50

Mathematics, 03.09.2021 16:50

Mathematics, 03.09.2021 16:50