Business, 27.08.2019 22:30 Kyliehayden05

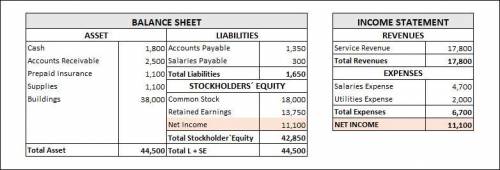

Below is the complete list of accounts of cobras incorporated and the related balance at the end of march. all accounts have their normal debit or credit balance. supplies, $1,100; buildings, $38,000; salaries payable, $300; common stock, $18,000; accounts payable, $1,350; utilities expense, $2,000; prepaid insurance, $1,100; service revenue, $17,800; accounts receivable, $2,500; cash, $1,800; salaries expense, $4,700; retained earnings, $13,750. required: prepare a trial balance with the list of accounts in the following order: assets, liabilities, stockholders' equity, revenues, and expenses.

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 11:30, zahradawkins2007

Marta communications, inc. has provided incomplete financial statements for the month ended march 31. the controller has asked you to calculate the missing amounts in the incomplete financial statements. use the information included in the excel simulation and the excel functions described below to complete the task

Answers: 1

Business, 22.06.2019 12:00, lyn36

In mexico, many garment or sewing shops found they could entice many young people to work for them if they offered clean, air conditioned work areas with high-quality locker rooms to clean up in after the work day. typically, traditional garment shops had to offer to get workers to apply for the hard, repetitive, and somewhat dangerous work. a. benchmark competitive wages b. compensating differentials c. monopoly wages d. wages based on human capital development of each employee

Answers: 3

Business, 22.06.2019 12:10, latdoz0952

Which of the following is not part of the mission statement of the department of homeland security? lead the unified national effort to secure america protect against and respond to threats and hazards to the nation ensure safe and secure borders coordinate intelligence operations against terrorists in other countries

Answers: 1

Business, 22.06.2019 15:00, shakaylaousley1997

Portia grant is an employee who is paid monthly. for the month of january of the current year, she earned a total of $8,388. the fica tax for social security is 6.2% of the first $118,500 earned each calendar year and the fica tax rate for medicare is 1.45% of all earnings. the futa tax rate of 0.6% and the suta tax rate of 5.4% are applied to the first $7,000 of an employee's pay. the amount of federal income tax withheld from her earnings was $1,391.77. what is the total amount of taxes withheld from the portia's earnings?

Answers: 2

You know the right answer?

Below is the complete list of accounts of cobras incorporated and the related balance at the end of...

Questions in other subjects:

English, 05.03.2021 01:10

Mathematics, 05.03.2021 01:10

Arts, 05.03.2021 01:20

Mathematics, 05.03.2021 01:20

Mathematics, 05.03.2021 01:20