Business, 27.08.2019 22:30 georgeena8

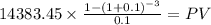

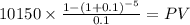

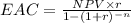

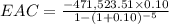

You are evaluating two different silicon wafer milling machines. the techron i costs $290,000, has a three-year life, and has pretax operating costs of $67,000 per year. the techron ii costs $510,000, has a five-year life, and has pretax operating costs of $35,000 per year. for both milling machines, use straight-line depreciation to zero over the project’s life and assume a salvage value of $40,000. if your tax rate is 35 percent and your discount rate is 10 percent, compute the equivalent annual cost for both machines. which do you prefer? why?

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 01:10, ltawiah8393

Suppose someone wants to sell a piece of land for cash. the selling of a piece of land represents turning econ

Answers: 3

Business, 22.06.2019 11:20, murarimenon

Camilo is a self-employed roofer. he reported a profit of $30,000 on his schedule c. he had other taxable income of $5,000. he paid $3,000 for hospitalization insurance. his self-employment tax was $4,656. he paid his former wife $4,000 in court-ordered alimony and $4,000 in child support. what is the amount camilo can deduct in arriving at adjusted gross income (agi)?

Answers: 2

Business, 22.06.2019 14:30, rakanmadi87

If a product goes up in price, and the demand for it drops, that product's demand is a. elastic b. inelastic c. stable d. fixed select the best answer from the choices provided

Answers: 1

You know the right answer?

You are evaluating two different silicon wafer milling machines. the techron i costs $290,000, has a...

Questions in other subjects: